RSI Stocks Hidden Bullish Divergence and Stocks Hidden Bearish Divergence Stocks Setups

Hidden divergence trading setup is used as a possible sign for a stocks trend continuation. Hidden divergence set up occurs when price retraces to retest a previous high or low.

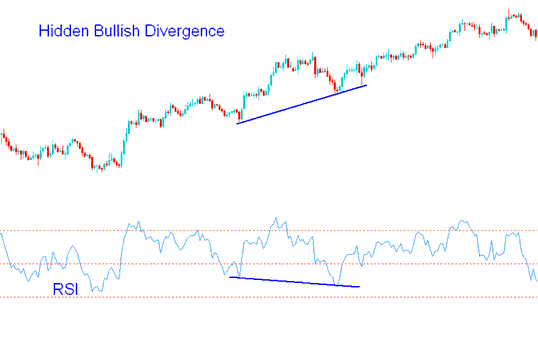

Hidden RSI Stocks Trading Bullish Divergence

Hidden RSI stocks bullish divergence setup forms when price is making a higher low (HL), but the oscillator is showing a lower low (LL).

Hidden bullish divergence occurs when there is a retracement in a upward trend.

RSI Stocks Hidden Bullish Divergence - Hidden Divergence Stocks Setup

This hidden divergence trading set up confirms that a price retracement move is exhausted. This hidden divergence indicates underlying strength of an upward stock trend.

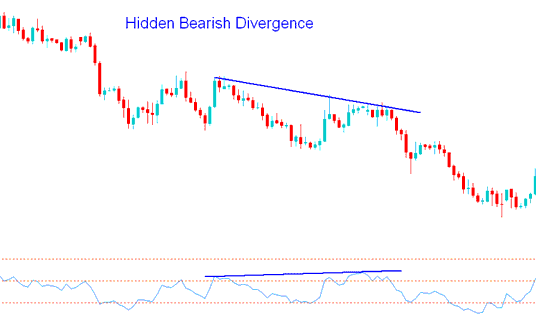

Hidden RSI Stocks Trading Bearish Divergence

Hidden RSI stocks bearish divergence setups forms when price is making a lower high (LH), but oscillator indicator is showing a higher high ( HH ).

Hidden bearish divergence occurs when there is a retracement in a down-wards trend.

Stocks Hidden Bearish Divergence - Trading Hidden Bearish Stocks Trading Divergence Stocks Setup

This hidden bearish stocks RSI setup confirms that a price retracement move is exhausted. This divergence indicates underlying strength of a downwards stock trend.