RSI Stocks Indicator Overbought & Oversold Levels

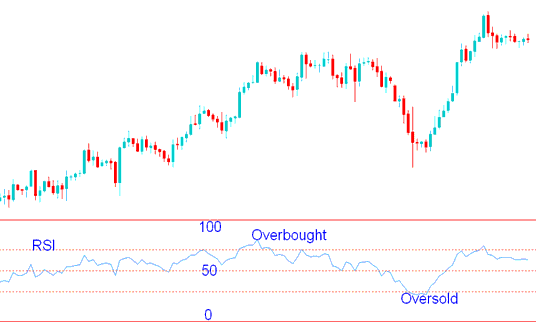

RSI technical indicator values of above 70 are considered to be over bought: stocks traders consider points above the 70 level as market tops & good points for taking profits.

RSI technical indicator values of below 30 are considered to be over sold: stocks traders consider points below the 30 level as market bottoms & good points for taking profits.

These overbought and oversold stocks levels should be confirmed by RSI center line crossovers stocks signals. If these regions give a market top or bottom, this stocks signal should be confirmed with RSI center line crossover stocks signal. This is because these overbought and oversold levels are prone to giving whipsaws in the stocks market.

In the stocks example shown & described below, when the RSI hit 70, it showed that the stocks was overbought, and this could be considered a signal that the trend could reverse.

The stocks chart then reversed the stocks trend after a short while & started to move downwards, until it got to the oversold levels. This was considered a stocks market bottom after which the stock chart started to move upwards again.

Overbought & Oversold Levels - RSI Stocks Strategies Methods

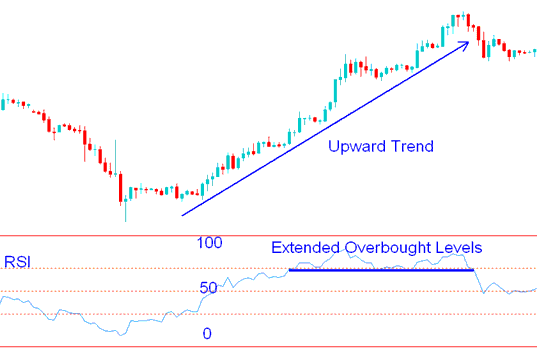

Over Extended Overbought and Oversold Levels

When the stocks market is trending strongly upwards or downwards the RSI indicator will stay at these overbought and oversold levels for a long time. When this happens these overbought and oversold regions cannot be used as stocks market tops and stocks market bottoms because the RSI indicator will stay at these levels for an extended period of time. This is the reason why we say that the overbought and oversold regions are prone to stocks whipsaws and it is best to confirm these stocks signals using RSI center-line cross-over strategy.

Over Extended Overbought and Oversold Levels - RSI Stocks Indicator Strategy