How Stochastic Oscillator Stocks Indicator Works

The Stochastic oscillator stocks indicator uses time periods to calculate the fast & slow lines. Number of time periods used to calculate the %K and %D line depends on what purpose a trader is using the Stochastic oscillator stocks indicator for.

- A trader using the Stochastic oscillator stocks indicator in combination with a stocks trend indicator to see overbought and oversold levels, trader can use periods 10 periods.

- The default period used by stochastic stocks oscillator indicator is 12.

Traders should not use stochastic stocks indicator alone for making stocks decisions, but should use this Stochastic oscillator stocks indicator in combination with other stocks indicators.

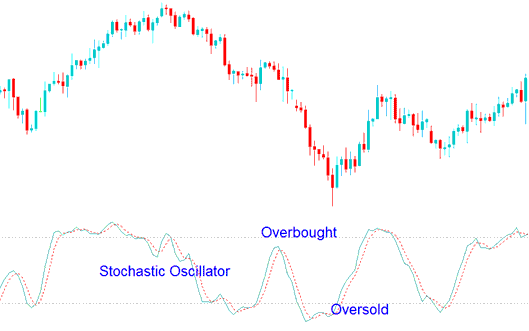

In ranging stocks markets this Stochastic oscillator stocks indicator can be used to show oversold/overbought levels as potential profit taking points when trading the stocks market.

Oversold & overbought stocks levels by default are 20 and 80, but other stocks traders use 30 and 70.

To look for "overbought" region at the indicator's 80% stochastic stocks oscillator mark is used

To look for "oversold" region 20% stochastic stocks oscillator mark is use.

The overbought and oversold levels are displayed as dotted horizontal lines on the stochastic oscillator stocks indicator. These levels can also be adjusted to the 30 & 70 levels.

Overbought and Oversold Levels on Stochastic Oscillator Indicator