T3 Moving Average Stocks Analysis & T3 Moving Average Stocks Signals

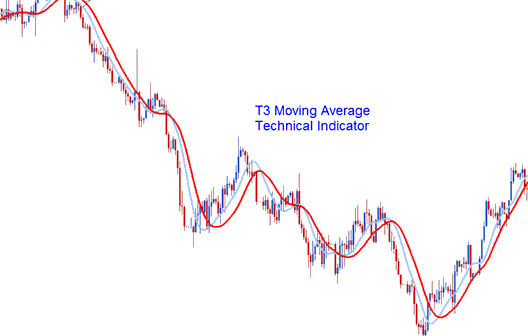

T3 uses a Smoothing factor/technique to produce trading signals that are similar to those of the moving averages, but are more accurate than those of the Moving Average. The T3 is a modification of method used to calculate the original Moving Average and it has a smoother curve and it does not lag the stocks market as much as the Moving Average. This Indicator follows stocks price action and adjusts itself to the direction of the market.

Stocks Analysis & Generating Stocks Signals

The T3 moving average is similar to the original MA, & it can be traded in the same way as the original Moving Average indicator.

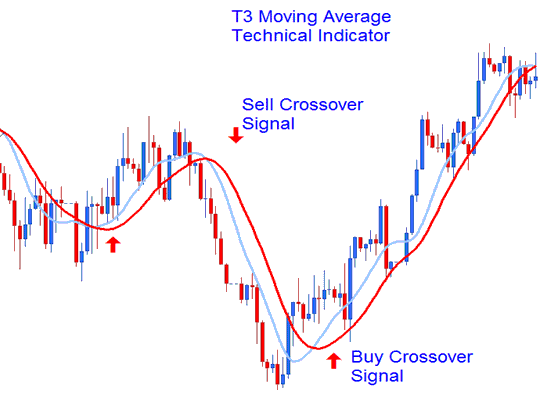

Moving Average Stock Trading Crossover Trade Signal

This Technique involves using 2 T3 Moving Average and generating signals when the 2 cross each either upwards generating an upwards stocks trend signal or cross downwards generating a downward stocks trend Signal.

Crossover Signal

Crossover Signal

Bullish Stocks Trend - Stocks Prices are bullish as long as price action remains above the indicator. When this move happens it implies that stocks prices are bound to continue moving upwards.

Bearish Trend - Stocks Prices are bearish as long as price action remains below the T3 Average. When the stocks price is below the indicator it implies that stocks price is bound to continue moving downwards.

Whipsaws - This is a smoothed indicator which is not prone to giving out whipsaws, since it's smoothed it is less responsive to stocks price spikes, therefore a stocks price spike will not skew the data used to calculate and draw it.