Williams Percent R Stocks Analysis & Williams Percent R Stocks Signals

Williams %R Technical Stocks Indicator Developed by Larry Williams

Williams %R indicator is pronounced as Williams percent R indicator. Williams %R Technical Stock Indicator is a momentum oscillator used to analyze overbought and oversold levels in the stock trading markets.

The William % Range oscillator is similar to the Stochastic Oscillator indicator, apart from that fact that the % R is drawn upside down on a negative scale that's from 0 to -100 & the indicator doesn't apply a smoothing factor.

Williams %R, Percent R Technical Stock Indicator - Stocks Indicators

The Williams %R indicator analyzes the association of the closing stocks prices relative to the High and Low range over a selected number of n candles.

- The closer the closing stocks price of a candlestick is to the highest high of the range selected the closer to zero the %R reading will be.

- The closer the closing stocks price of a candlestick is to the lowest low of the range selected the closer to -100 the %R reading will be.

When doing technical analysis a trader should ignore the minus sign placed before the value, for examples -40, the - sign should be ignored, just remember the indictor values are placed in an upside down manner.

- At zero: If the closing stocks price of the candlestick is equal to the highest high of the range the William %R reading will be 0.

- At -100: if the closing stocks price of the candlestick is equal to the lowest low of the range the William %R reading will be -100.

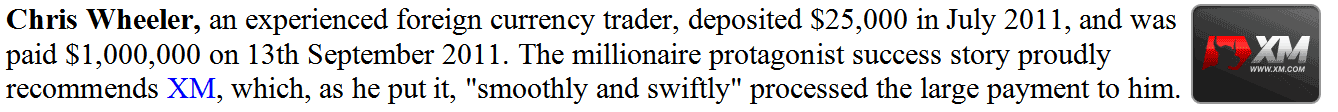

Williams Percent R Technical Indicator

Oversold/Overbought Levels on Indicator

- Overbought- William %R values from 0 to -20 are considered overbought while

- Oversold- Williams %R values from -80 to -100 are considered oversold.

As for trading overbought/oversold levels it is best to wait for a stocks instrument to change direction before taking a signal in the opposite direction. For Example if a stocks instrument is oversold it is best to wait for the stocks trend to reverse and start to head in an upward direction before buying the stocks.

Stocks Trend Reversal Stocks Signals

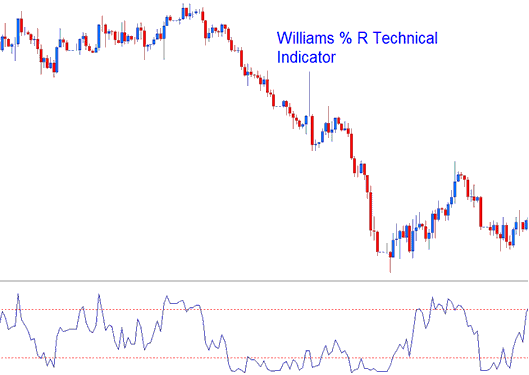

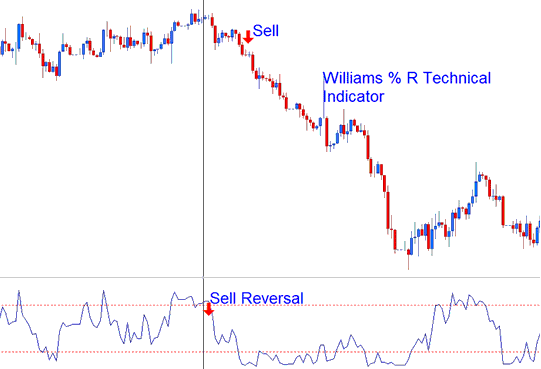

The William %R indicator used to predict a stocks trend reversal signal when trading a stocks. Williams % R indicator always predict a reversal using the following technique

Bearish Reversal Stocks Signal- Williams Percent Range indicator forms a peak and turns down a few days before the stocks price trend peaks and turns down. The example shown & described below displays %R giving a reversal stocks signal before stocks price starts to head down and change to a down stock trend.

Bearish Reversal Stocks Signal after Stocks Trading Uptrend

Bullish Reversal Stocks Signal- Williams Percent Range indicator forms a trough and turns up a few days before the stocks price trend bottoms and turns up.

Bullish Reversal Stocks Signal after Stocks Trading Downtrend