Reversal Candle Patterns - Hammer Candlestick Pattern

Hammer Bullish XAUUSD Candlesticks Pattern

Reversal candlesticks patterns occur after an extended prior trend. Therefore, for a candles pattern to qualify as a reversal candles pattern there must be a prior trend.

These reversal candlesticks patterns are:

- Hammer Candlesticks Pattern & Hanging Man Candle Pattern

- Inverted Hammer Candles Pattern and Shooting Star Candle Pattern

- Piercing Line XAUUSD Candlestick Pattern & Dark Cloud Cover Candle Pattern

- Morning Star Candles and Evening Star Candles

- Engulfing Candles Patterns

Hammer Candles Pattern & Hanging Man Candle Pattern

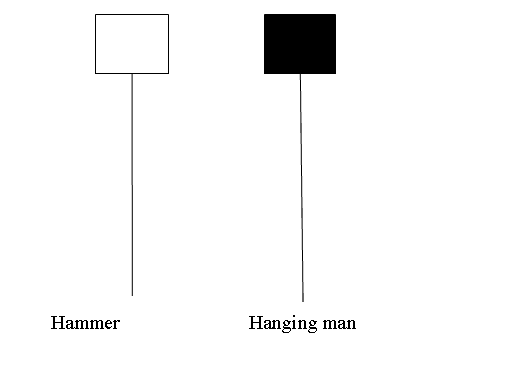

Hammer Candlesticks Pattern & Hanging Man Candlestick Pattern candles look alike but hammer candlesticks pattern is bullish reversal candlesticks pattern & hanging man is a bearish reversal candlestick pattern.

Hammer Candles Pattern and Hanging Man Candle Pattern

Hammer Candlesticks Patterns

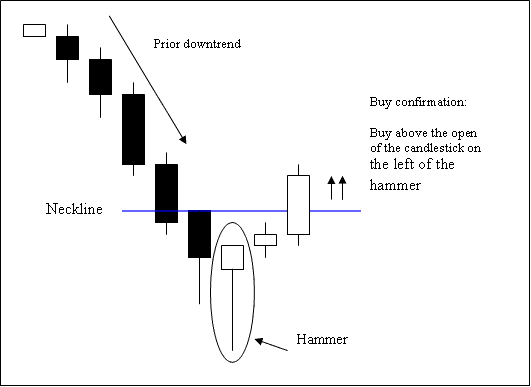

Hammer Candlesticks Pattern is a potentially bullish candle pattern which occurs during a xauusd downwards trend. It is named so because the xauusd market is hammering out a market bottoms.

A hammer candlestick pattern has:

- A small body

- The body is at the top

- The lower shadow is two or three times length of the real body.

- Has no upper shadow or very small upper shadow if present.

- The color of the body is not important

Hammer Candlesticks

Technical Analysis of Hammer Candles Pattern

The buy trading signal is confirmed when a candle closes above the opening gold price of the candle to the left side of this hammer candlestick pattern.

Stop loss orders should be set a few pips just below the low of the xauusd hammer candlestick pattern.