When to Determine When to Buy a XAUUSD

A trader should know when to open a buy order, just because the xauusd market is bullish and gold trading prices are moving upward it doesn't mean you can just buy anywhere. You need to know the art of where to open a buy order.

Consider this, the xauusd market is bullish you come and buy at the top of the xauusd trend where the prices look so bullish that it creates the illusion that the xauusd market will never retrace and if you do not buy now you will be left behind, only that just after you buy the xauusd market immediately retraces 200 pips. This is not the art of how to buy. Even if the xauusd market goes up and the gold market price returns to where you bought you are still not in profit, you have done zero work and you have just wasted your time. You need to know where to buy at the best gold price & at the best time so that the xauusd market does not retrace on you just when you have bought.

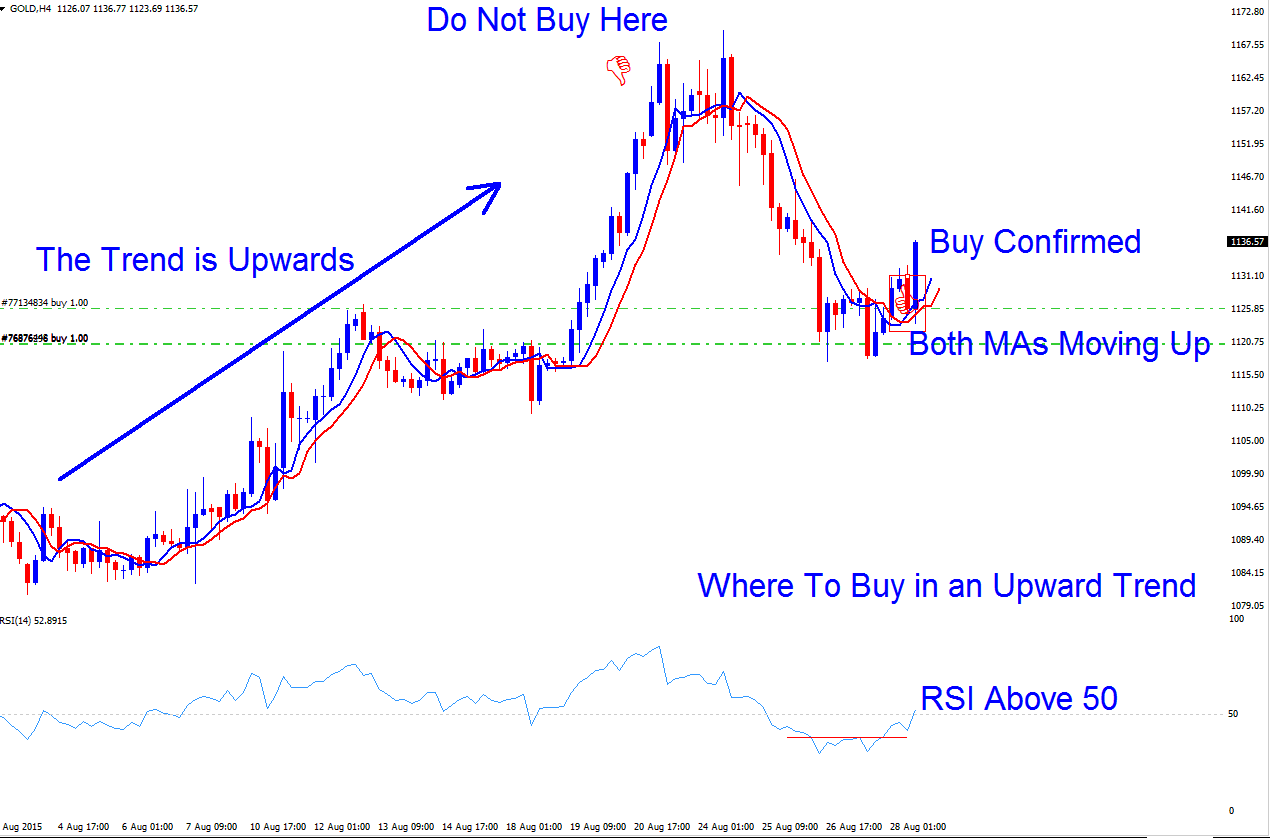

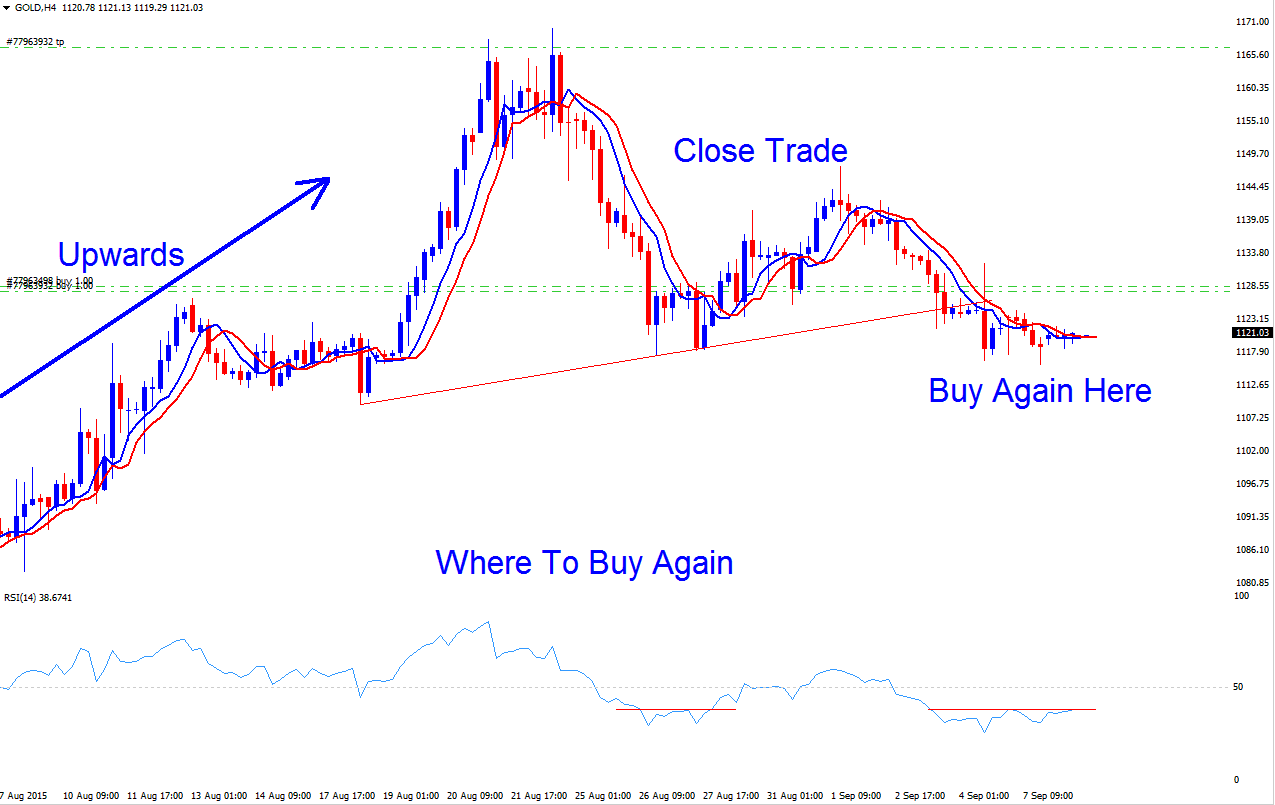

The chart below shows an upward trending market. It shows where most traders buy, most traders buy when the upward market is looking obvious, this is not where to buy, you buy when the xauusd market xauusd trend is not looking obvious, this is when there is a retracement in the gold trading price. Always aim to buy after a retracement as shown below.

The art of this type of buying is that you buy after a retracement, therefore even if gold trading price does not move up immediately, the retracement will already be played out halfway or 3 quarter way, therefore instead of you entering a buy which retraces 200 points as in the case which you buy at the top, you buy after a retracement therefore even if gold trading price were to retrace on you it will only retrace a few points and once the xauusd trend resumes you will make profit much faster.

For example if you buy after the gold trading price has retraced 150 points and the total retracement is 200 points, then you buy position will only retrace on you by 50 points instead of 200 points. And by the time the upward trend resumes and gold prices moves upward 200 points to clear the retracement at this point you'll be 150 points in profit, thus you will have saved time as well as by entering at the best point you will make money on the retracement. This is the art of buying if you want to make money when trading an upwards trending market.

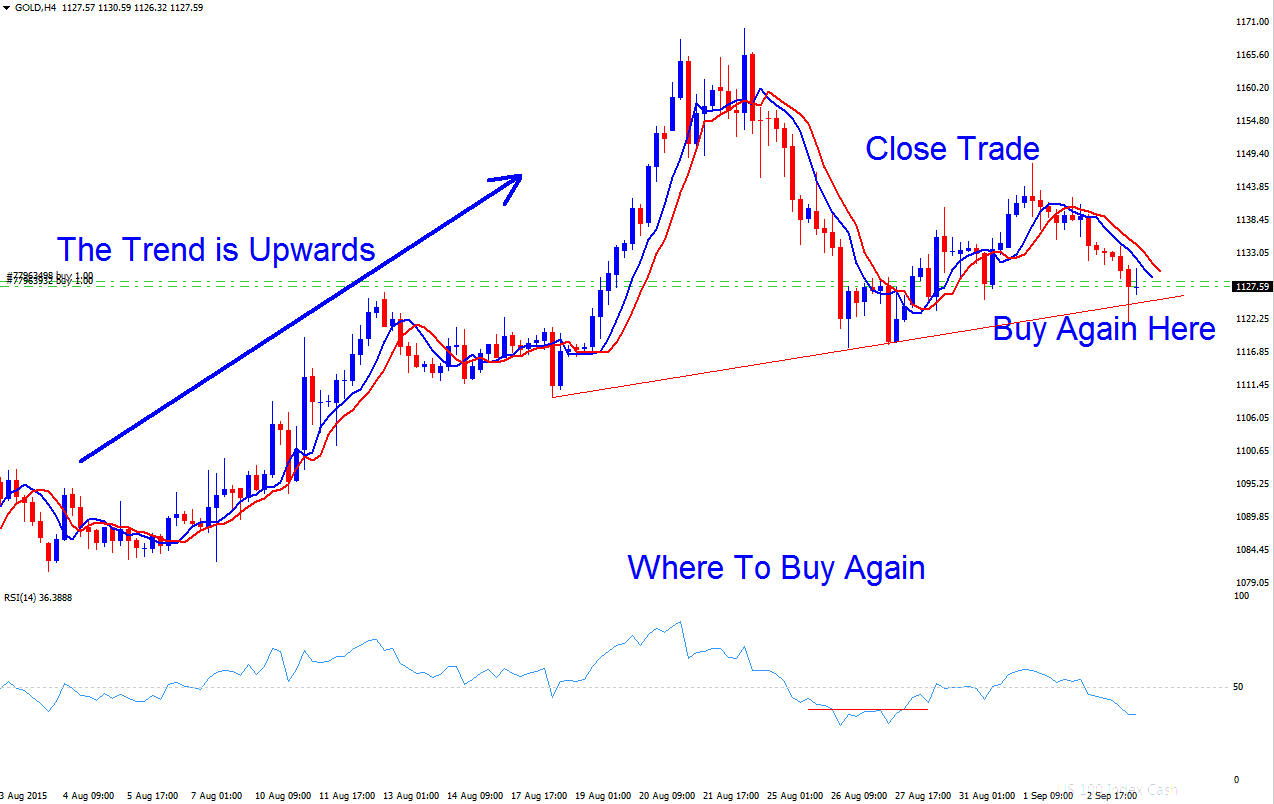

The example shown below shows where to not to buy and where to buy after a retracement, the buy was quickly confirmed by the moving average which started to move up and RSI went to above the 50 center line mark. Buying here after the retracement shows as a trader your position did not have a lot of drawdown and you started to make money immediately therefore making this a low risk trade.

Where to close buy orders

Knowing where to buy also means knowing where to close you orders and take profit.

For the above setup we will be using the RSI overbought signal. Once the RSI goes above 70 & then close below this level we shall consider this as a sell signal and we shall close all open buy orders.

And then wait for another retracement & open another buy order after a retracement & repeat this strategy.

We shall take a screen shot of this trade to show you where to close the xauusd orders after the xauusd market moves up as these trade is real time at the time of writing this article.

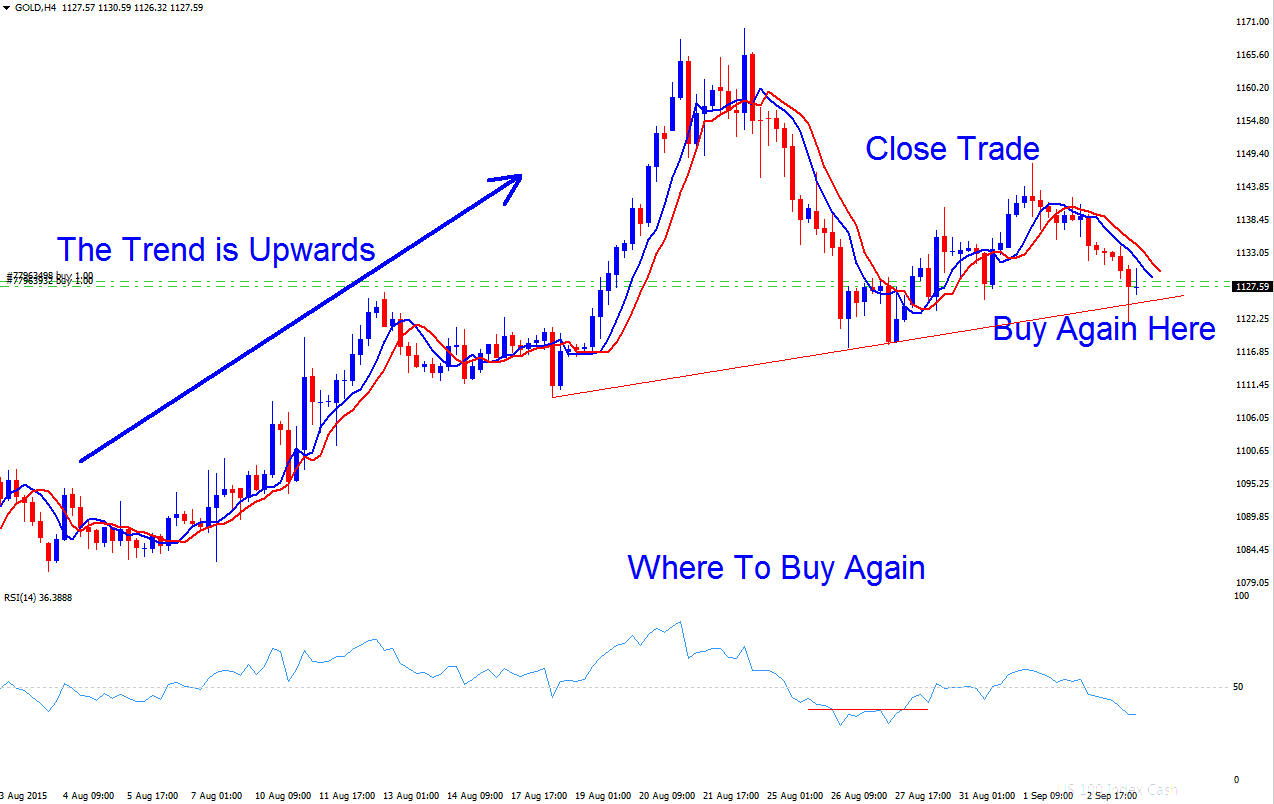

Where to buy again

Because the xauusd trend is upward & we only buy after a retracement then as a buyer you would have waited for the setup to buy again & this is after a retracement.

This would have been best place to buy as this is the level where the current market is oversold.

You can also wait for confirmation of the above signal as shown below:

Buy trade setup confirmed

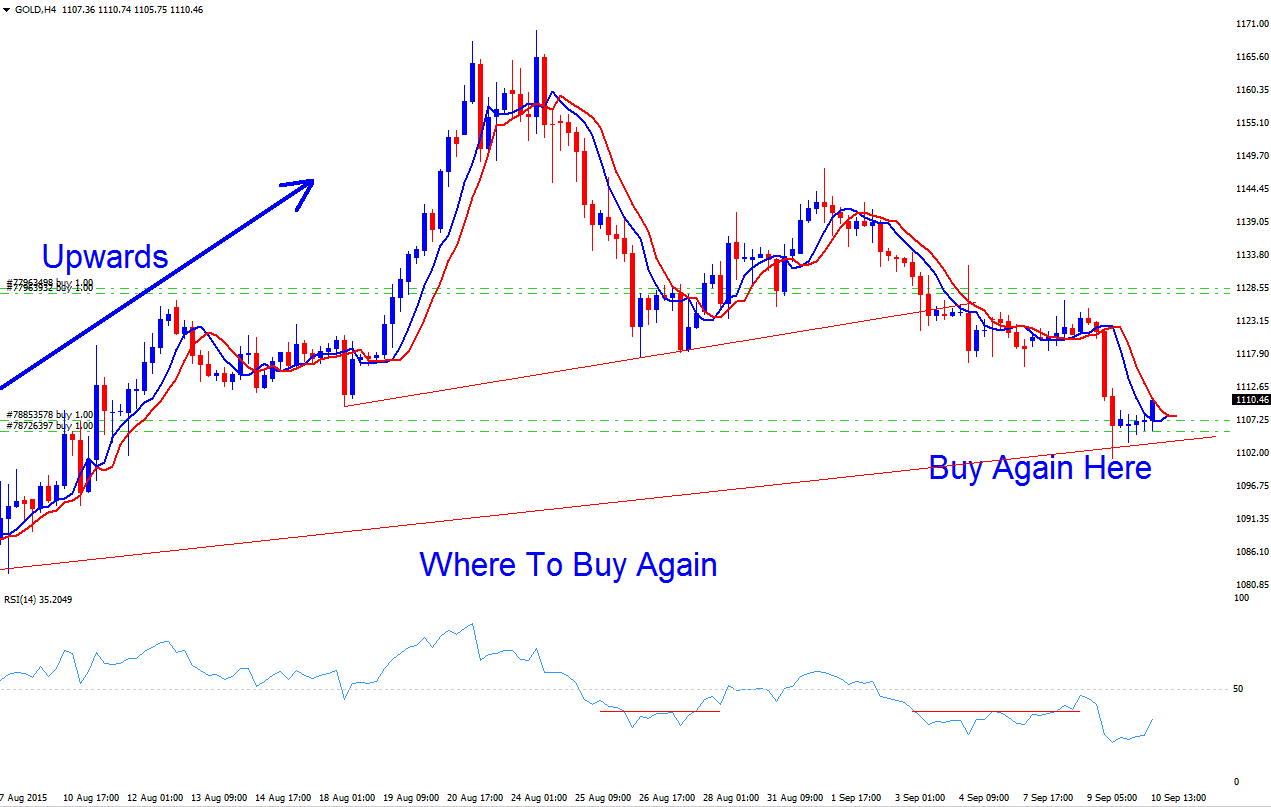

What if a Trader Buys and The Retracement Continues Downwards?

This is a good question, what if where you buy is not where the retracement stops & the down move continues?

This trade did just that & retraced 200 points down from our buy point as displayed below.

So the first thing to know is that this is an upward xauusd trend and the retracement has moved 671 pips from the top but using our strategy we have been caught by only 200 pips instead of the 671 pips. This is the first reason why you should not buy at the top and instead wait for a retracement then buy. That way you will only be caught by a fraction of the retracement and not the whole retracement, therefore saving you from a lot of drawdown on the trade.

The next step is that because you will not be over leveraging your trades you'll still have enough money to absorb the drawdown. You'll then open a new trade after this retracement starts to move upward as displayed above.

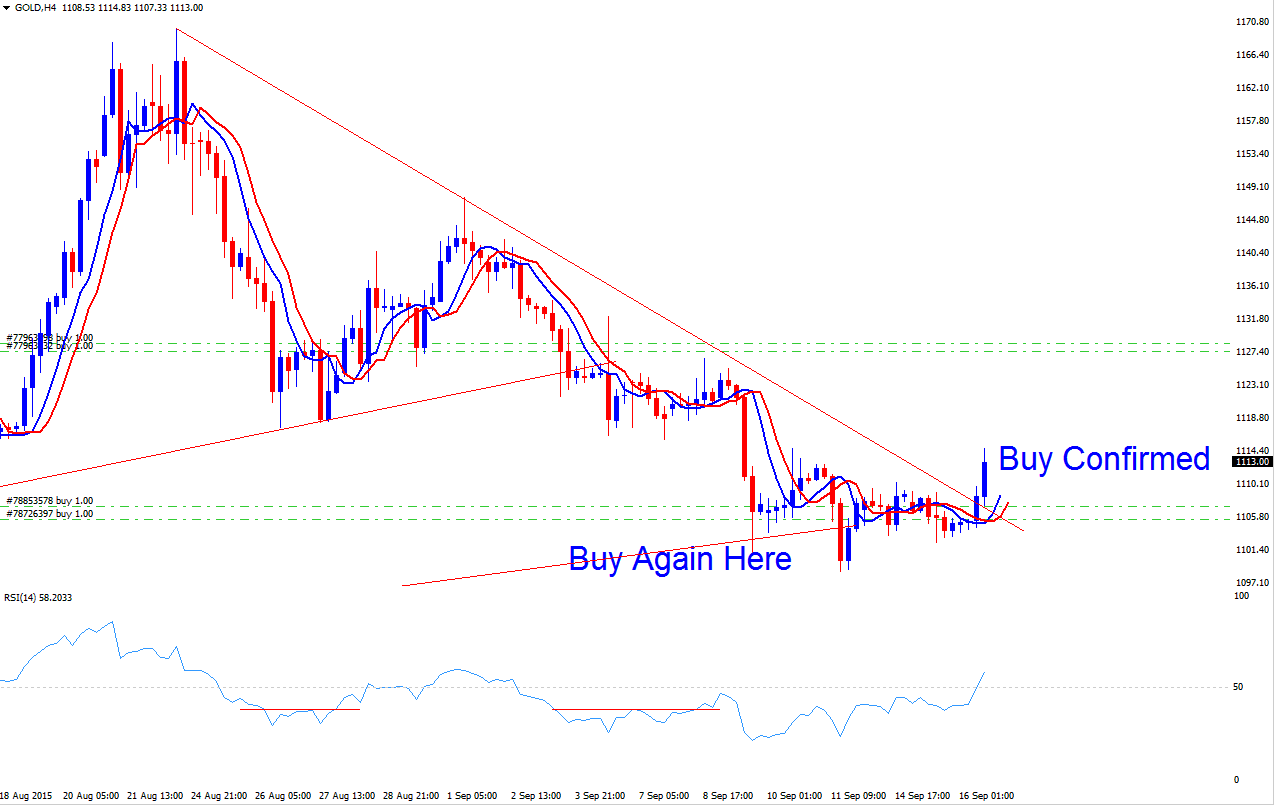

From the above trade setup our newly opened trade went up by 70 points immediately after opening this trade. As a trader you will need to close these new trades at the earliest times so that you can reduce your risk and at the same time book some profit amidst all the retracements happening.

For this trade our take profit will be set at 1144 or we monitor the gold trading price chart & close this trade if the momentum of this trades starts to slowdown.

We shall take a screenshot of this trade after the xauusd market xauusd trend has developed.

The buy xauusd trade was confirmed after there was a consolidation - both moving averages are now heading upwards & the RSI indicator is above 50. There was even a short term downwards xauusd trend as shown by the downward trend line that has now been broken.

As a trader you can see that using our strategy we have been able to reduce our drawdown despite the short term down gold trend. Should the xauusd market go up to where our first trade was then we shall have added profit to our trading account. The reason why we have added this profit will not be because that we were able to perfectly time the xauusd market but because we have entered the xauusd market when the possibility of draw down is very minimal. This means our risk reward ratio is high enough to enable us to extract profit from the xauusd market using this strategy.

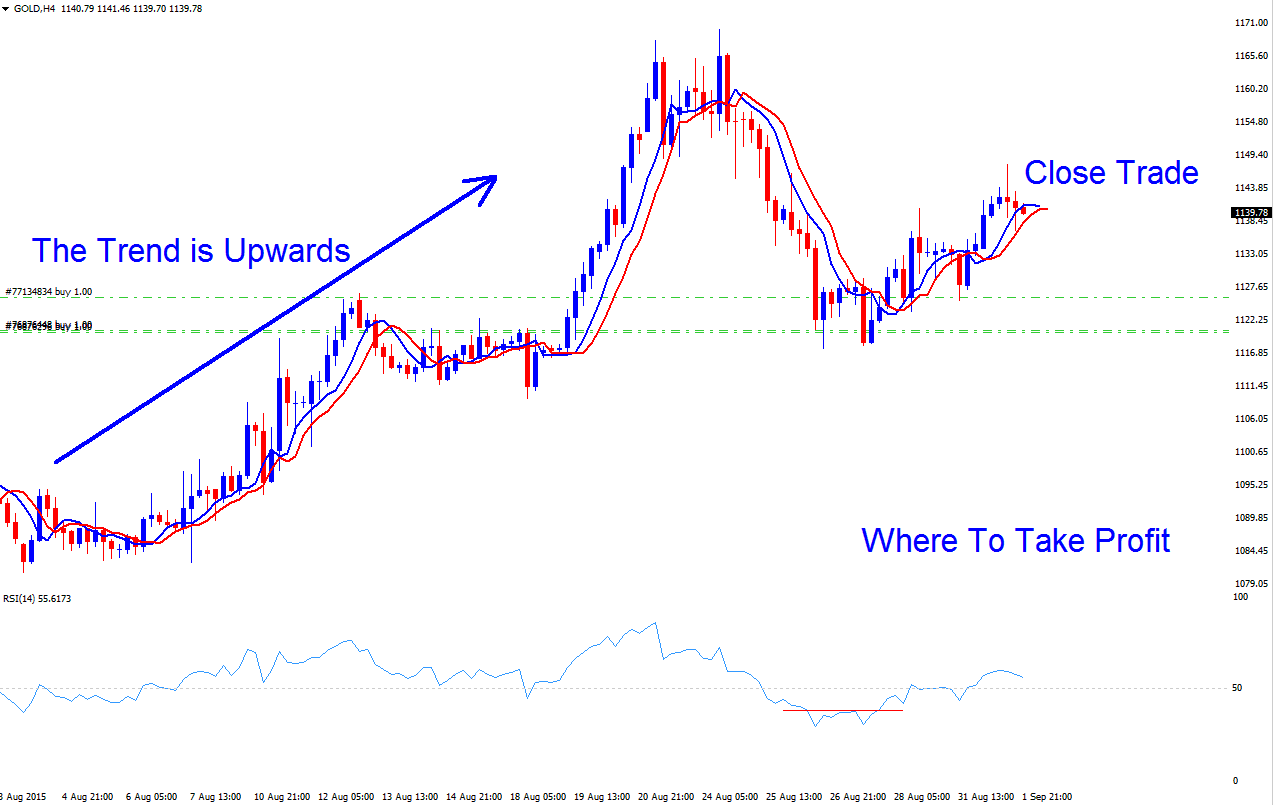

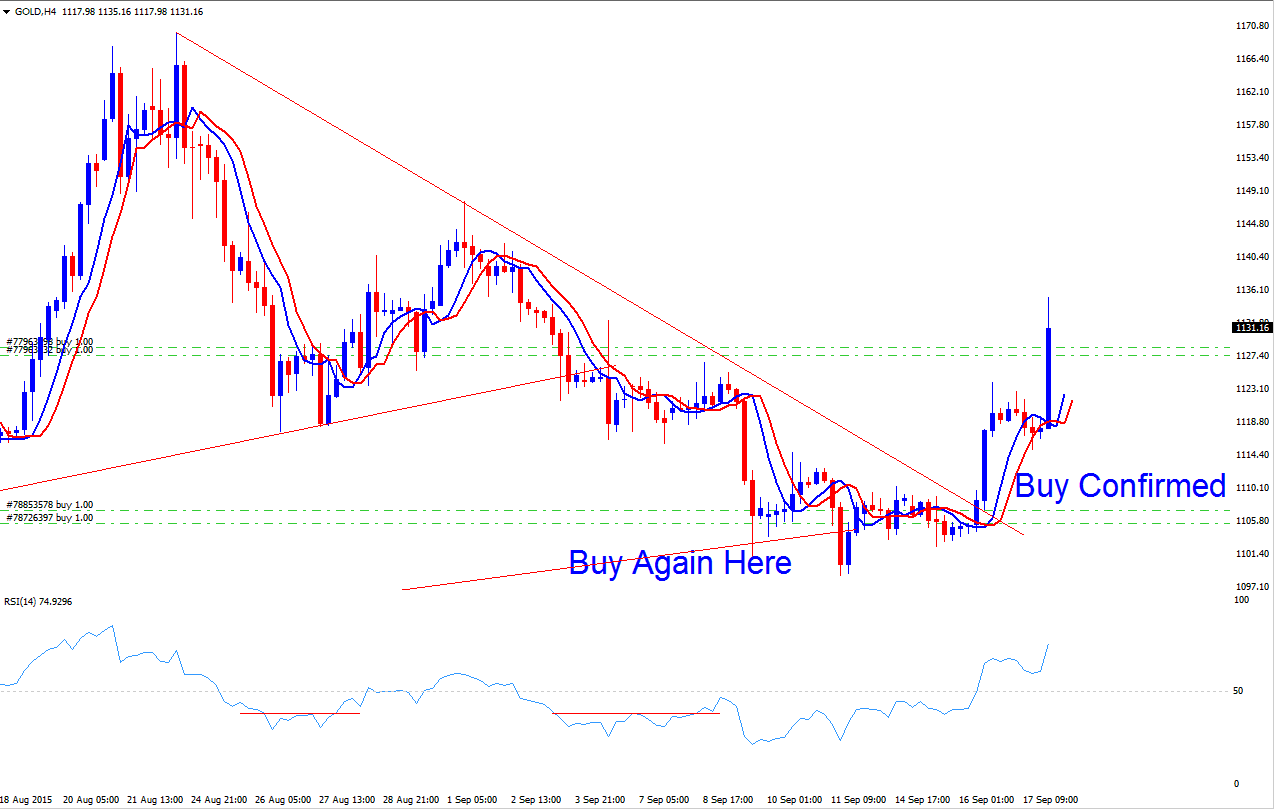

The following area is where you close your trade, always quit while you're ahead & wait for another retracement to buy.

It is best to close trades here because the xauusd market is a little overbought at this particular time. Close trade set a buy limit and wait for tomorrow.

Based on our strategy the best place to place buy limit would be at 1123 or 1122 or 1121 just above 1120.

Just in case there is a continuation of this bullish upwards market, we also set a buy stop order at 1136 just above most recent high that way our buy xauusd trade will still be opened either way.

The thing to remember is retracement before buy - the aim is to first reduce any amount of drawdown before starting to chase profit.

The next thing you've to be sure with this strategy is that the current long term xauusd trend is upward, that way you are trading with the xauusd trend - you can use moving average cross over technique on the weekly chart to do this.

The same concept of retracement before sell can be used to open sell gold trades when in a downward bearish trending market.