Bollinger Band & Price Volatility

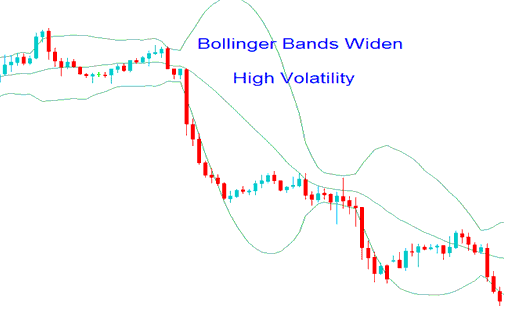

High forex price swings push closes far from the moving average. Bollinger Bands widen to fit most price moves, covering 95% near the mean.

The width of the Bollinger Band forex indicator expands in tandem with increased forex price variability. This phenomenon manifests as the bollinger band distending around the current price. Such an expansion typically signifies a continuation pattern in forex, suggesting the price is set to maintain its trajectory, usually providing a continuation forex signal.

The accompanying example of the Bollinger band forex indicator clearly illustrates and visualizes the Bollinger bulge formation.

High Forex Price Volatility - Bollinger Band Bulge

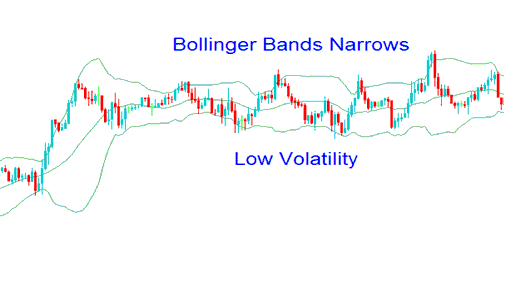

When forex price volatility is low: prices close closer toward the moving average, the width decreases to reduce the possible forex price action movement which can fall within 95 % of the mean.

When the foreign exchange price experiences low volatility, the market typically enters a period of consolidation, awaiting a significant breakout. If the Bollinger Bands indicator is observed to be tracking horizontally, the best course of action is to remain inactive and abstain from opening any trade positions.

See Bollinger Bands example below when they get narrow.

Low Price Volatility - Bollinger Band Indicator - Bollinger Band Squeeze

More Courses & Courses:

- How to Use DeMarks Range Projection Indicator on MT4 for Indices

- Setting Up US 100 in the MetaTrader 4 Mobile App

- Instructions on setting Stochastic in a chart

- How to put Fibonacci expansion levels in MT5.

- How do you practice and learn the currency market?

- Indicators Useful for Setting Stop Loss Orders Specifically for XAUUSD Trades

- How to Set Up Forex Automated EA Bots/Robots on the MT5 Program

- Indicator for determining trend trigger factors

- Gold Trading Applications for iPad

- How to Analyze and Interpret Strategy Signals