Choppiness Index Expert Advisor Setup - Setting Up Choppiness Index Expert Advisor

Choppiness Index Expert Advisor Setup - Setting Up Choppiness Index Expert Advisor - A trader can come up with an Choppiness Index Expert Advisor based on the Choppiness Index indicator explained below.

Choppiness Index Expert Advisor rules can be combined with other Forex technical indicators to come up with other EA Robots that trade using rules based on two or more indicators combined to form a trading system.

Choppiness Index Technical Analysis and Choppiness Index Signals

Developed by E.W. Dreiss

Choppiness Index was designed to be an easy but practical indicator to help Forex traders to determine if the currency prices are trending or consolidating.

This Indicator is similar to ADX which is also designed to evaluate the strength or momentum of a trend and determine if the market is trending or consolidating.

Choppiness Index Expert Advisor Setup

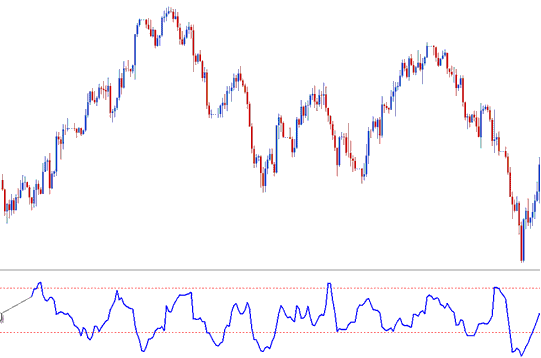

The Choppiness Index uses a scale of between 0 and 100. It also typically uses upper and lower bands at 61.8 & 38.2 respectively.

This indicator is plotted by first calculating the true range for each period and then adding the values of n-periods.

Second, it calculates the highest value and lowest value over n-periods and calculates their difference.

Third, it divides the sum of the true ranges and calculates the base-10 logarithm of this value.

Finally, it divides this value by the base-10 logarithm of n-periods and multiplies the results by 100.

Choppiness Index Technical Analysis & How to Generate Signals

Choppiness Index is a directionless indicator meaning it doesn't determine in which direction the forex market is moving.

Its basic principle is that the more heavily the market is trending over the last number of n-periods the closer to zero the Choppiness Index will be and the more heavily the market is consolidating that is moving sideways in a ranging or chopping manner, over the last n-periods the closer to 100 the Choppiness Index will be.

Indicator values of above 61.8 indicate that the market is ranging/ choppy (moving sideways and consolidating).

Higher values occur during/after a strong consolidation phase. Higher values could also be interpreted as a signal of a potential upcoming breakout after a significant consolidation has occurred.

Choppiness Index values of below 38.2 indicate that the market is trending.

Lower values occur during/after a strong trending phase. Lower values could also be interpreted as a signal of a potential upcoming consolidation and choppiness after a strong trend phase has occurred.