Parabolic SAR Technical Analysis and Parabolic SAR Signals

Developed by J. Welles Wilder.

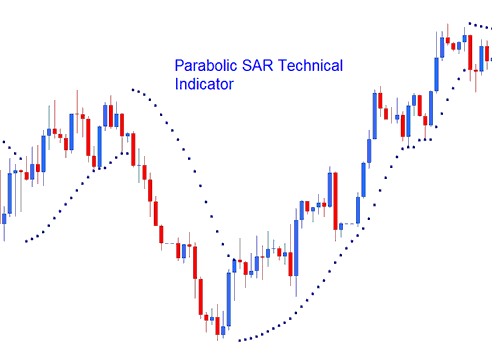

The Parabolic SAR is used to set trailing price stops. This indicator is usually referred to as the "SAR" (stop-and-reversal) and it is used to follow price action closely.

- In an Uptrend, the stop and reversal will trail below the market price

- In a downtrend, the stop and reversal will trail above the market price

FX Technical Analysis & How to Generate Signals

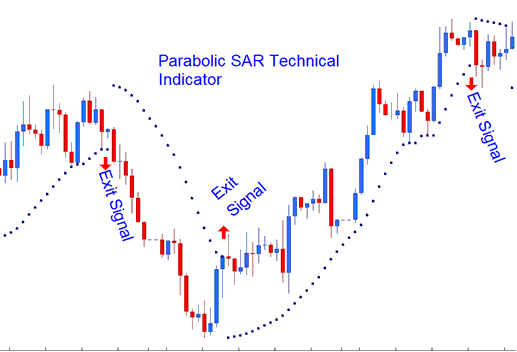

This indicator provides excellent exit points.

Exit FX Trading Signal for Buy trades

Traders should close long trade positions when price falls below the technical indicator.

If you are trading long i.e. The price is above the stop and reversal, the SAR will move up every day, regardless of the direction that price action is moving. The movement of the indicator depends on the number of pips that prices move. When the SAR changes the direction then the market trend also changes to down. This generates the exit signal for long trades.

Exit Forex Trading Signal for Sell trades

Traders should close short trade positions when price rises above the technical indicator.

If you are trading short i.e. The price is below the stop and reversal, the SAR will move down every day, regardless of the direction that price action is moving. The movement of the indicator depends on the number of pips that prices move. When the SAR changes the direction then the market trend also changes to up. This generates the exit signal for short trades.

Exit Trading Signal for Buy and Sell trades