Bollinger Bands Indices Price Action in Trending Stock Indices Markets

Bollinger Bands indicator is used to identify & analyze trending stock indices markets. In a trending stock indices market this stock indices technical indicator clearly shows up or down direction.

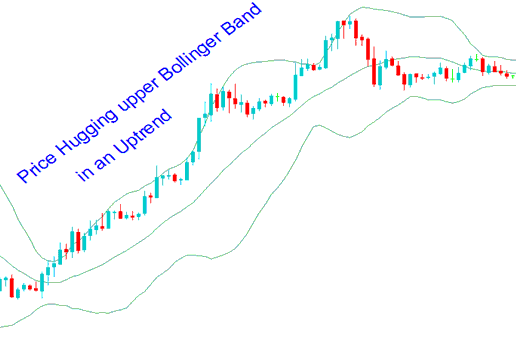

Bollinger Bands indicator can be used to determine the direction of the Stock Indices trend. In an upward stock indices trend Bollinger Bands indicator will clearly show the direction of the trend, it will be heading upwards and stock index price will be above middle Bollinger.

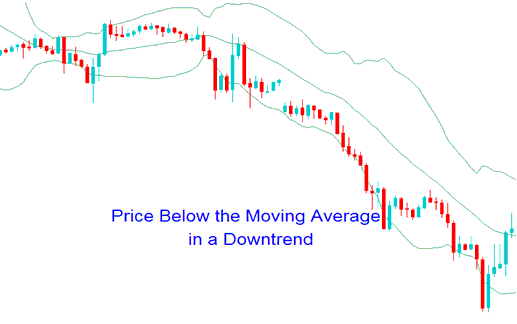

In a downward stock indices trend the stock index price will be below the middle band the bands will be heading downwards.

By observing the Bollinger bands stock indices indicator patterns formed by Bollinger bands a trader can determine the direction in which the stock indices market is likely to move.

Bollinger Bands Stock Indices Indicator Patterns and Continuation Stock Indices Signals

Indices Upward Trend

- During an upswing, the stock indices candlesticks will stay within the upper Bollinger band the central moving average.

- Indices Prices that close above the upper band are a sign of bullish continuation stock index trading signal.

- Indices Prices can hug/ride the upper band during an upwards stock indices trend

Upward Stock Indices Trend Strategy Using Bollinger Band Stock Indices Strategy

Stock Indices Downwards Trend

- During a down swing, the stock indices candles will stay within the moving average & the lower band.

- Indices Prices that close below the lower band are a sign of bearish continuation stock index trading signal.

- Indices Prices can hug/ride the lower band during an downwards stock indices trend

Downwards Stock Indices Trend Strategy Using Bollinger Band Stock Indices Strategy