Bullish Divergence - Classic Bullish Divergence & Hidden Bullish Divergence

When it comes to bullish divergence there are 2 bullish divergence trading setups mainly traded in the forex market - these setups are; Classic Bullish Forex Trading Divergence and Hidden Bullish Divergence.

Classic Bullish FX Trading Divergence

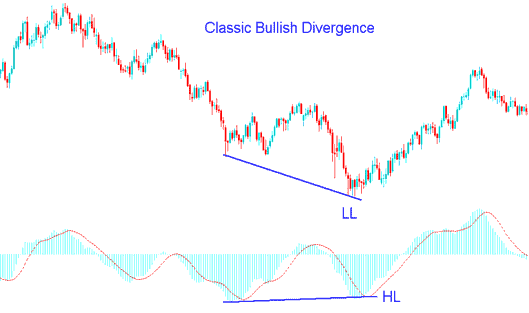

Classic bullish divergence set-up occurs when price is making lower lows (LL), but the oscillator is making higher lows (HL). The example below shows a picture of this setup.

Classic Bullish Divergence - Bullish Divergence Forex Trading

This example uses MACD indicator as a Forex divergence indicator.

From the above bullish divergence example the price made a lower low(LL) but the indicator made a higher low(HL), this shows there is a divergence between the price & the indicator. This signal warns of a possible forex trend reversal.

Classic bullish divergence signal warns of a possible change in the Forex trend from down to up. This is because even though the price went lower the volume of sellers who pushed the price lower was less as illustrated by MACD indicator. This indicates underlying weakness of the downward Forex trend.

Hidden Bullish Forex Trading Divergence

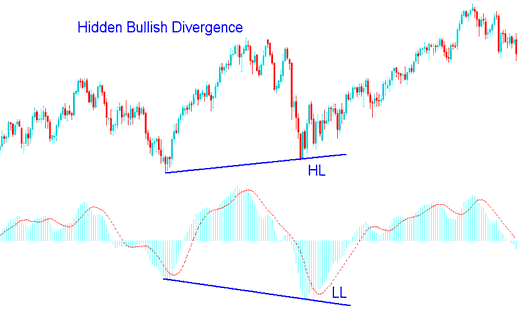

This bullish divergence setup happens when price is making a higher low (HL), but the oscillator (indicator) is showing a lower low (LL). To remember them easily think of them as W-shapes on Chart patterns. It occurs when there is a retracement in an upwards Forex trend.

The bullish divergence example below shows an image of this setup, from the screenshot the price made higher low (HL) but the indicator made a lower low (LL), this shows that there was a divergence signal between the price and indicator. This signal shows that soon the market uptrend is going to resume. In other words it shows this was just a retracement in an uptrend.

Hidden Bullish FX Trading Divergence- Bullish Divergence Forex Trading

This bullish divergence confirms that a retracement move is complete and indicates underlying strength of an uptrend.