Divergence in Forex Setups - Bullish and Bearish Divergence Forex Trading

Divergence in Forex is one of the trade setups used by Forex traders. It involves looking at a chart and one more indicator. For our example we shall use the MACD indicator.

To spot this divergence trading setup find two chart points at which price makes a new swing high or a new swing low but the MACD indicator does not, indicating a Divergence in Forex between price and momentum.

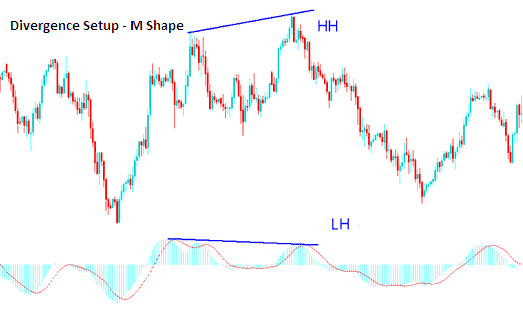

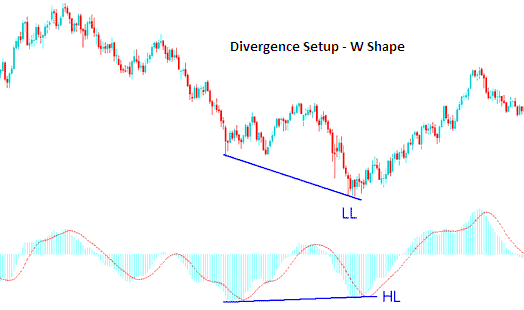

To look for Divergence in Forex we look for two chart points, two highs that form an M-shape on the chart or two lows that form a W-Shape on the chart. Then look for same M-shape or W-Shape on Forex indicator you use to trade.

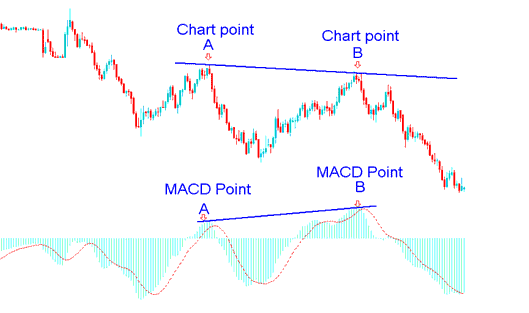

Example of a Forex Divergence in Trade Setup:

In the EURUSD chart below we spot two chart points, point A & point B (swing highs). These 2 points form an M-shape on the price chart.

Then using MACD indicator we check highs made by MACD, these are highs which are directly below Chart points A & B.

We then draw one line on the Forex chart & another line on the MACD indicator.

Drawing Divergence in Forex Trading Lines

The chart above shows example of one of the four types of Divergence in Forex, the one above is known as hidden bearish Divergence in Forex, one of the best type to trade. Types of Divergence in Forex are covered in the next lesson.

How to spot Divergence in Forex

In order to spot Forex divergence signal we look for the following:

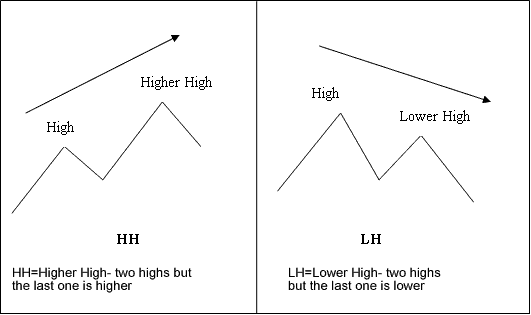

- HH=Higher High- two highs but the last one is higher

- LH= Lower High- two highs but the last one is lower

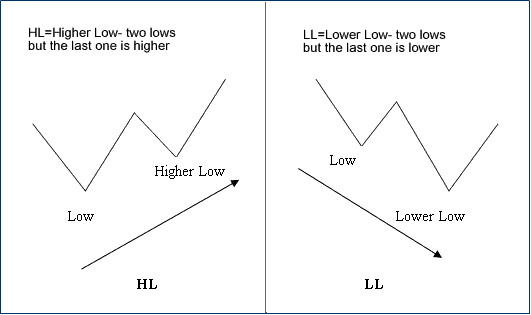

- HL=Higher Low- two lows but the last one is higher

- LL= Lower Low- two lows but the last one is lower

First let us look at the illustrations of these trading terms:

M-shapes dealing with Forex Trading price Highs

Divergence in Forex

W-Shapes dealing with price lows

Divergence in Forex

Example of M Shapes

Divergence in Forex

Examples of W Shapes

Divergence in Forex

Now that you have learned the Divergence in Forex trading terms that are used to explain trading set-up. Let us look at the two types of Divergence in Forex and how to trade these chart setups.

There two types are:

- Classic Divergence in Forex

- Hidden Divergence in Forex

These two set ups are explained on following courses below