Forex Divergence Definition - RSI Divergence Trading Indicator Technical Analysis

Divergence trading concept is a concept where a trader will for a difference between the currency price movement with the movement of a technical indicator. For our example we shall use the RSI indicator to explain divergence trading.

RSI indicator is one of the oftenly used divergence technical indicator. This indicator is an oscillator similar to the RSI and it can be used to trade divergence setups just the same way as the RSI indicator.

RSI Technical Analysis and RSI Signals

RSI Forex Trading Divergence Indicator

RSI Bullish Forex Trading Divergence Setups - RSI FX Trading Divergence Indicator

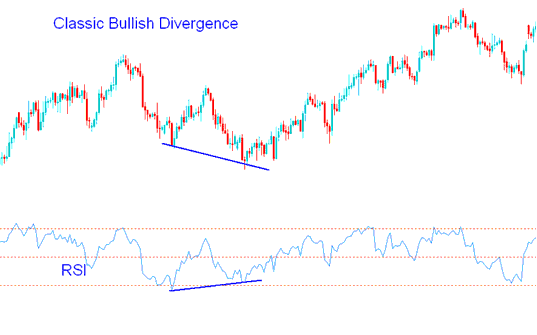

Classic RSI Bullish FX Trading Divergence

RSI classic bullish divergence occurs when price is making lower lows (LL), but the RSI technical indicator is making higher lows ( HL ).

Classic Bullish Divergence - RSI Forex Divergence Definition

RSI classic bullish divergence warns of a possible change in the forex trend from down to up. This is because even though the price went lower the volume of sellers who pushed the price lower was less as illustrated by the RSI indicator. This is an technical indicator of the underlying weakness of the downwards trend.

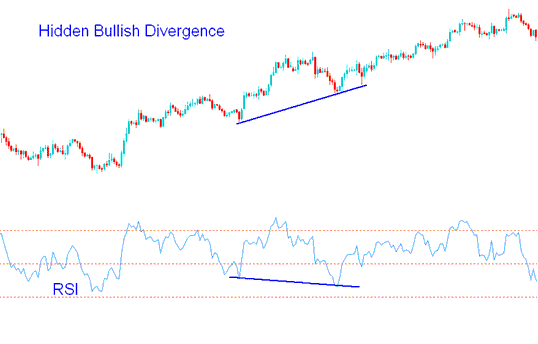

Hidden RSI Bullish Forex Trading Divergence Setup

Forms when price is making a higher low (HL), but the RSI technical indicator is showing a lower low ( LL ).

RSI hidden bullish divergence occurs when there is a retracement in an uptrend.

Hidden Bullish Divergence - RSI Forex Divergence Definition

This set-up confirms that a retracement move is complete. This RSI divergence setup indicates underlying strength of an uptrend.

RSI Bearish Forex Trading Divergence - RSI Forex Trading Divergence Indicator

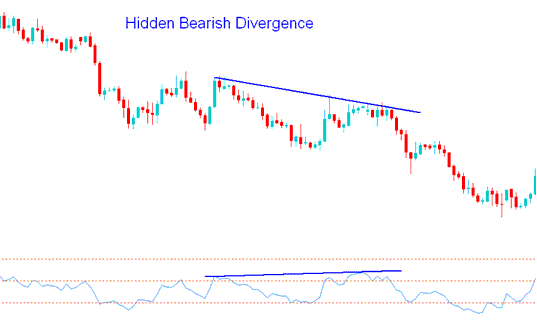

Hidden RSI Bearish Forex Trading Divergence Setup

Forms when price is making a lower high (LH), but the oscillator technical trading indicator is showing a higher high ( HH ).

Hidden bearish divergence forms when there's a retracement in a downtrend.

Hidden Bearish Divergence - RSI Forex Divergence Definition

This set-up confirms that a retracement move is complete. This divergence indicates underlying strength of a downtrend.

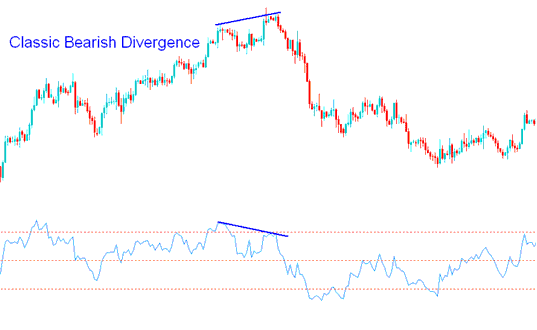

RSI Classic bearish FX Trading Divergence

RSI classic bearish divergence occurs when price is making a higher high (HH), but the RSI technical indicator is making lower high ( LH ).

Classic Bearish Divergence - RSI Forex Divergence Definition

RSI Classic bearish divergence warns of a possible change in forex trend from up to down. This is because even though the price went higher the volume of buyers that pushed the price higher was less as illustrated by the RSI indicator. This is an technical indicator of the underlying weakness of the upwards trend.