Stochastic Oscillator Divergence Technical Indicator Forex Trading

Divergence trading is one of the signals that can be generated when using the divergence indicator stochastic oscillator.

Divergence on stochastic indicator is a signal that a rally or retracement is losing steam & is likely to reverse. It means that the last buyers or last sellers are pushing the price in one way while the majority of other traders have stopped trading in that way and are cautious of a price correction or retracement.

There are 4 types of divergences that can be traded using this divergence indicator.

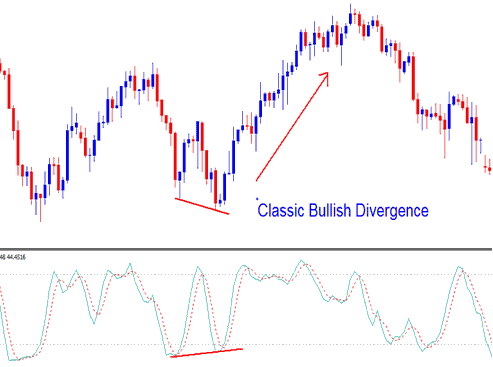

Example 1: Classic Bullish FX Trading Divergence

A Bullish Divergence in stochastic technical indicator and price is followed by a rise in price.

stochastic divergence indicator

When the price is making new lows the stochastic divergence indicator is not moving past its previous lows it is an indication that the down trend is about to reverse & a bullish rally is likely to occur.

In the example above the price set a new low but it was not coupled with a new low in the measure of Stochastic, when price formed a new low then the indicator should have followed suit, but the stochastic did not therefore the divergence setup.

This divergence trading setup is even stronger because there is combination of a divergence and then followed by a rise above the 20% level. This combines the Overbought and Oversold levels.

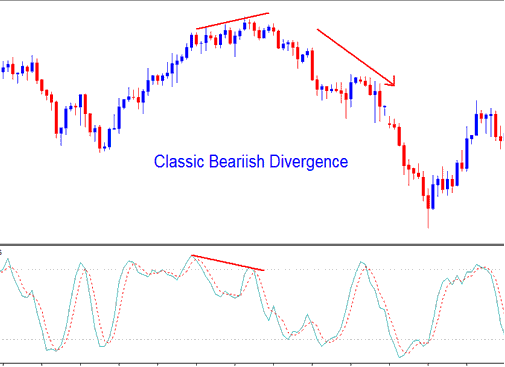

Example 2: Classic Bearish Forex Trading Divergence

A Bearish Divergence in stochastic technical indicator and price is followed by a drop in price.

stochastic divergence indicator

When price is making new highs but the stochastic divergence indicator is not moving beyond its previous high it is an indication the uptrend will reverse and that a bearish divergence will follow.

This trade setup is interpreted to be even stronger because there is a combination of a divergence with a dip below overbought 80 level.

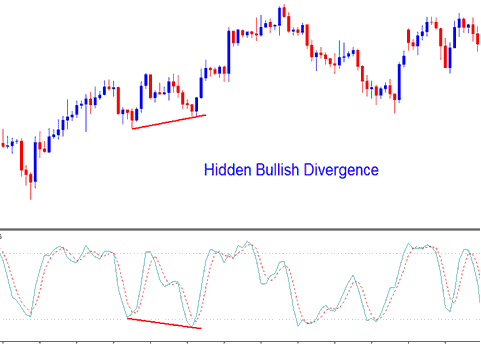

Example 3: Hidden Bullish FX Trading Divergence

This stochastic divergence indicator setup signifies a retracement in an upward trend. This is the best type of divergence to trade, because you are not trading a price trend reversal, but you are trading within the direction of the market trend.

stochastic divergence indicator

Even though, the stochastic oscillator stochastic divergence indicator made a lower low the price low was higher than the previous low (higher low). This means that even though the sellers made a good attempt to push price down as indicated by the stochastic divergence indicator, this was not reflected on the price, and the price did not make a new low. This is the best place to buy the currency, since it is even in an upward trend there's no need to wait for a confirmation trading signal, because you are buying in an upward forex market trend.

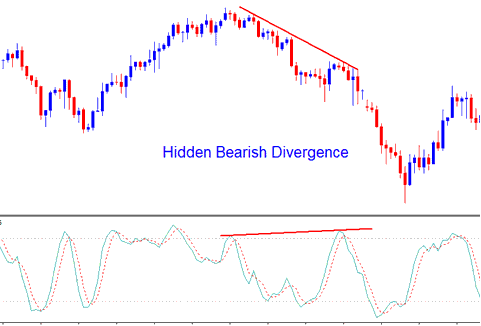

Example 4: Hidden Bearish Forex Trading Divergence

This setup signifies a retracement in a downward trend.

stochastic divergence indicator

This is the best type of divergence to trade with this stochastic divergence indicator, because you're not trading a price trend reversal, but you are trading within the direction of the market trend. This is the best place to sell currency, since it is even in a down trend there's no need to wait for a confirmation trading signal, because you're selling in a downwards Forex trend.