MACD Forex Whipsaws and False Signals in Bull and Bear Zones

Given that the MACD is a leading technical indicator prone to generating false signals or "whipsaws," we will examine a specific instance of a fakeout produced by this MACD. This will serve to emphasize the prudent approach of pausing and awaiting a conclusive confirmation signal before trading.

MACD Whipsaw - Forex Whipsaws

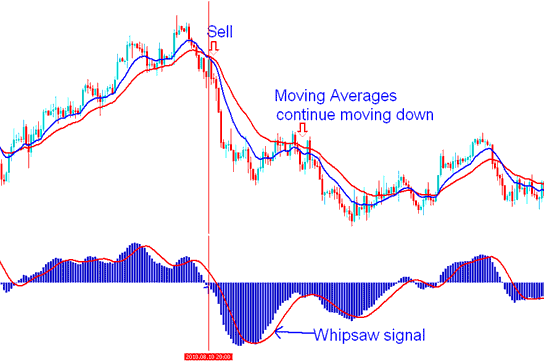

At the moment this buy signal was created and the MACD line was still below the zero center-line mark, the MACD provided a buy trade signal. The buy trading signal had not been confirmed at this time, and it led to a whipsaw fakeout, as seen by the moving averages MAs, which continued to decline.

A forex whipsaw signal occurs due to a rapid increase and decrease in price within a short timeframe, distorting the data utilized for calculating the moving averages that generate the MACD data. Such whipsaw fake-out movements are typically triggered by news events or announcements that create market noise.

Traders need to spot and handle a whipsaw - when the market swings up and then down. To avoid getting caught out by these fake moves, wait for solid confirmation of trading signals, like watching for the MACD to cross above or below the zero line.

Mitigating Fake-outs (Whipsaws) by Integrating MACD Crossover with Center-Line Crossover

Signal to buy: When the price crosses over, then goes up a lot, and then crosses over the centerline, the signal to buy is confirmed.

Sell trade signal - A sell trade signal is confirmed when there is a crossover, after price goes down a lot, and then the centerline is crossed over again.

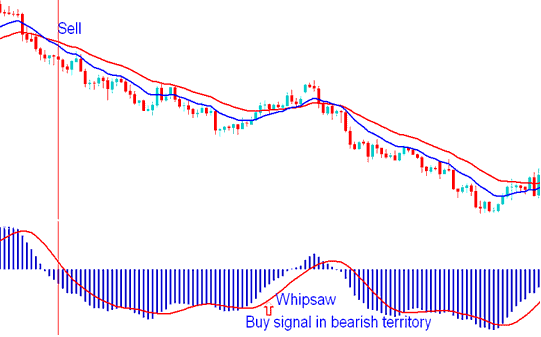

1. Buy Trade Signal in Bearish Territory Region Whipsaw

If a buy signal is produced/derived in a bearish territory, it may lead to a whip saw, particularly if the MACD centerline cross-over does not occur shortly after.

In the picture below, MACD shows a buy signal even though it looks like a bad time to buy: then, the MACD turns down and starts going down again, causing a forex whipsaw. Waiting for the centerline crossover can help you avoid the whipsaw.

In one situation, there was a momentary center-line crossing. This whipsaw fake-out signal would have posed challenges if using MACD in isolation, which is why it is beneficial to use MACD in conjunction with another indicator. The following illustration demonstrates the MACD combined with moving average analysis.

MACD Forex Whipsaw - Buy Signal in Bearish Territory

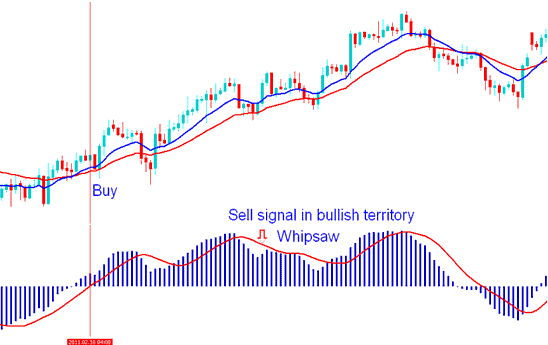

2. Sell Trade Signal in Bullish Territory Region Whipsaw

When a sell signal emerges in a bullish zone, it can potentially lead to a whipsaw, particularly if not quickly followed by a MACD center-line crossover.

In the illustration below, the MACD gives a sell signal even though it is in bullish territory, MACD then turns up & starts moving upwards again resulting in to a fake out. By waiting for centerline cross-over it's possible to avoid the whipsaw fakeout. In the example below by combining this MACD with the MA Cross-over Method you'd have avoided this whipsaw.

MACD Forex Whipsaw - Sell Signal in Bullish Territory

To completely circumvent false signals when employing the MACD for market trading, it is advisable to depend solely on the Centerline Crossover Signal as the definitive Buy or Sell indicator for the MACD.

More Topics & Lessons:

- Automated Forex Trading Strategy Using Bollinger Bands

- WallStreet 30 Stock Index Trading Strategy How to Create Indices Strategy for Trading/Transacting WallStreet 30

- How much is one pip worth in a nano account?

- How to Make a Plan for GBP NZD

- Utilizing the MT4 Bollinger Band Fibonacci Ratios Indicator for Analysis.

- Trading in MetaTrader 5: A Guide

- Training Guide for Gold Information Website