Hidden Bullish & XAUUSD Hidden Bearish Divergence Gold

Hidden divergence is used as a possible sign for a xauusd trend continuation after the price has retraced. It's a signal that the original xauusd trend is resuming. This is best setup to trade because it is in same direction as that of the continuing market trend.

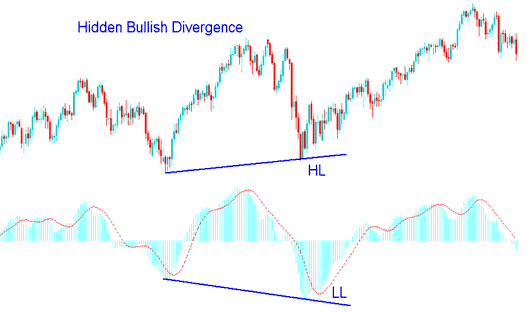

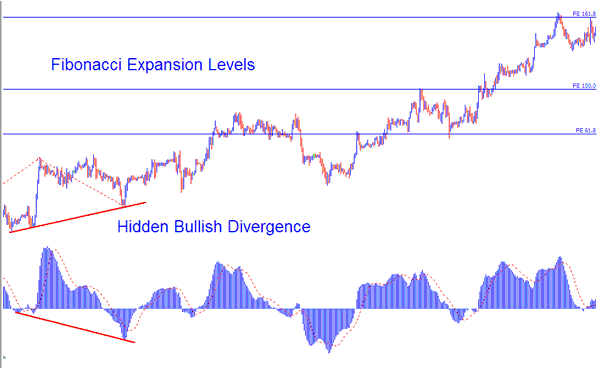

XAUUSD Hidden Bullish Divergence

This setup happens when price is forming a higher low (HL), but the oscillator (indicator) is showing a lower low (LL). To remember them easily think of them as W-shapes on Chart patterns. It occurs when there is a retracement in an upwards gold trend.

The example illustrated & shown below shows an image of this xauusd setup, from the screenshot the gold price made higher low (HL) but the technical indicator made a lower low (LL), this shows that there was a diverging signal between the gold price and indicator. This signal shows that soon the xauusd market up xauusd trend is going to resume. In other words it shows this was just a retracement in an upward xauusd trend.

This confirms that a retracement move is complete and indicates underlying strength of an upward gold trend.

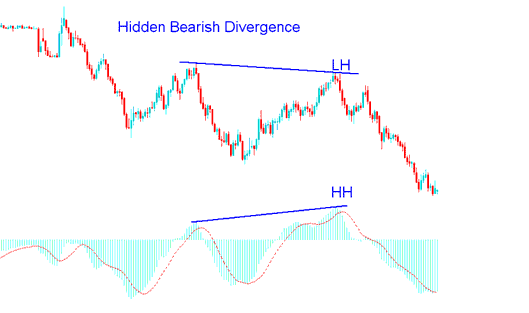

Gold Hidden Bearish Divergence

This setup happens when price is forming a lower high (LH), but the oscillator is showing a higher high (HH). To remember them easily think of them as M-shapes on Chart patterns. It occurs when there is a retracement in a downward trend.

The example illustrated & shown below shows an image of this xauusd setup, from the screenshot the gold price made a lower high (LH) but the technical indicator made a higher high (HH), this shows that there was a divergence between the gold price and indicator. This shows that soon the xauusd market down xauusd trend is going to resume. In other words it shows this was just a retracement in a downward trend.

This confirms that a retracement move is complete & indicates underlying strength of a downward gold trend.

Other popular technical indicators used are Commodities Channel Index indicator (CCI), Stochastic Oscillator, RSI and MACD. MACD & RSI are the best technical indicators.

NB: Hidden divergence is the best type to trade because it gives a signal that is in the same direction with the current market trend, thus it has a high reward to risk ratio. It provides for best possible entry.

However, a trader should combine this xauusd setup with another indicator like the stochastic oscillator or moving average and buy when the xauusd is oversold, and sell when the xauusd is overbought.

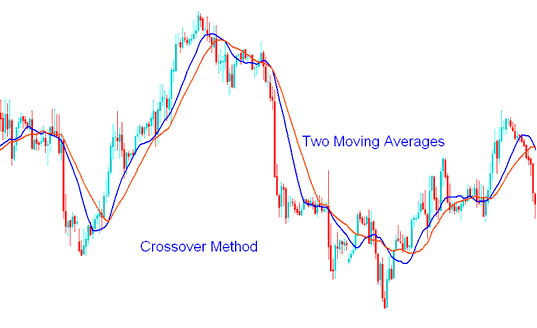

Combining Hidden Divergence with Moving Average Crossover Method

A good indicator to combine these xauusd setups is the moving average indicator using moving average crossover method. This will create a good trading strategy.

Moving Average Crossover Method

In this strategy, once the signal is given, a trader will then wait for the moving average cross-over technique to give a buy/sell signal in the same direction, if there is a bullish divergence set up between the gold price and indicator, wait for the moving average crossover system to give an upward cross-over signal, while for a bearish diverging setup wait for the moving average crossover system to give a downward bearish crossover signal.

By combining this xauusd signal with other technical indicators this way one will avoid whip-saws when it comes to trading this gold trading signal.

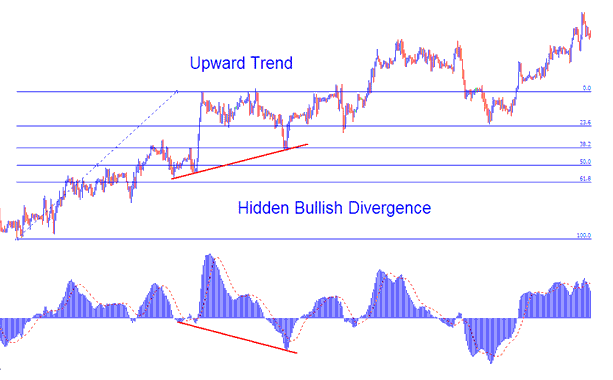

Combining with XAUUSD Trading Fib Retracement Levels

For this example we shall use an upwards market trend. We shall use the MACD indicator.

Because the hidden divergence is just a retracement in an upwards xauusd trend we can combine this xauusd signal with the most popular retracement tool that is the Fibonacci retracement levels. The example illustrated & shown below shows that when this xauusd setup appeared on the chart, the gold price had just hit the 38.20% level. When gold price tested this level, this would have been a good level to set a buy order.

Combining with XAUUSD Trading Fib Expansion Levels

In the xauusd example above once the buy xauusd trade was placed, a trader would then need to calculate where to place the take profit for this trade. To do this a trader would need to use the XAUUSD Trading Fib Expansion Levels.

The Fibo expansion was drawn as illustrated and shown on the trading chart as illustrated & shown below.

For this example there were three take profit levels:

Expansion Level 61.80% - 131 pips profit

Expansion Level 100.00% - 212 pips profit

Expansion Level 161.80% - 337 pips profit

From this strategy combined with Fibo would have provided a good strategy with a good amount of profit set using these take profit areas.