Creating a Forex Trading System: Indicator Based Trading System

A Forex System refers to a set of trading rules that you follow to manage your trades. These written forex trading rules will determine when you open a forex trade and when you will exit a forex trade. A forex trade system is created by combining two or more technical indicators.

For example, the Stochastic Oscillator technical indicator can be combined with other indicators to form a trading system. For this example - stochastic oscillator can be combined with the technical indicators below to come up with the following trading system.

- RSI indicator

- MACD indicator

- Moving Averages indicators

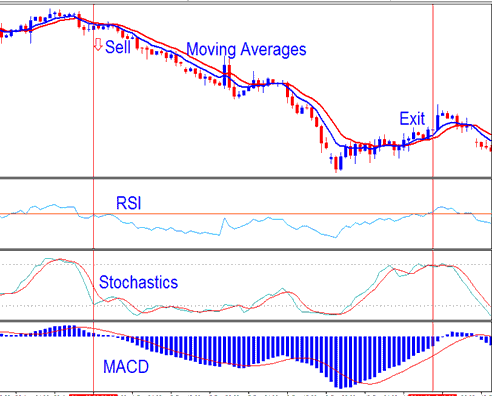

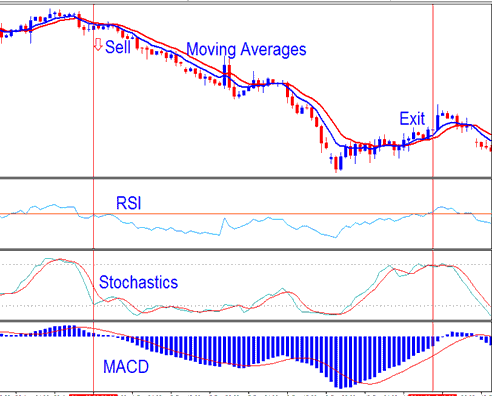

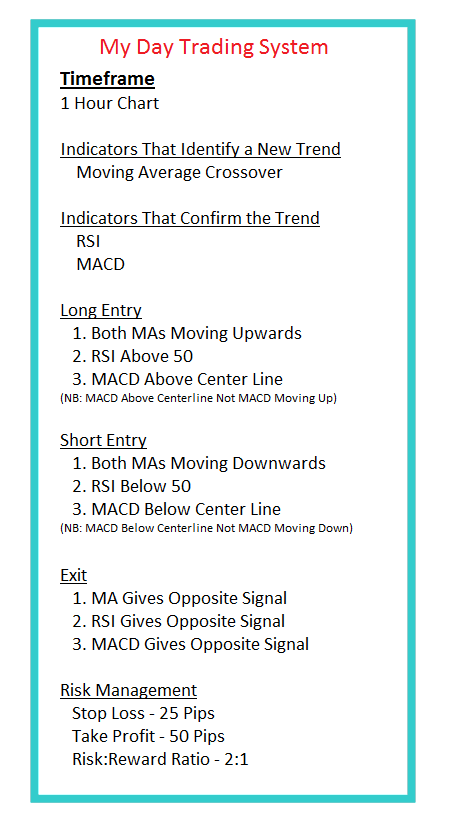

Example Forex System - MT4 Template Trading System Example

Creating a Forex System Example Template

So the question is how can a trader come up with trading systems that work like the forex trading system example above and how does one write it's trading rules? - to write the forex system trading rules follow the steps below.

Seven steps to creating an technical indicator based trading system

To come up with these set of trading rules we use the following seven steps.

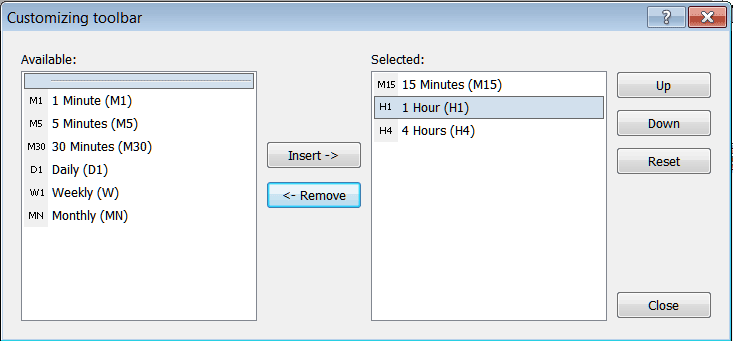

1. Choose your Chart Timeframe

This first step depends on how many hours you want to dedicate to forex trading. Whether you prefer sitting in front of the Desktop computer constantly for several hours analyzing short forex chart time frames OR you prefer setting up your forex charts using bigger chart time frames once or twice a day. Choosing a chart time frame will mainly depend on what type of trader you are.

Chart Time Frames in MetaTrader 4 Software

While testing your new Forex trading system you may want to find out about its performance on different chart time frames and then choose the most accurate & profitable chart time frame for you and your trading method.

2. Choose indicators to identify a new forex trend

The goal of a trader is to get into the trade as early as possible and take maximum advantage of forex price moves.

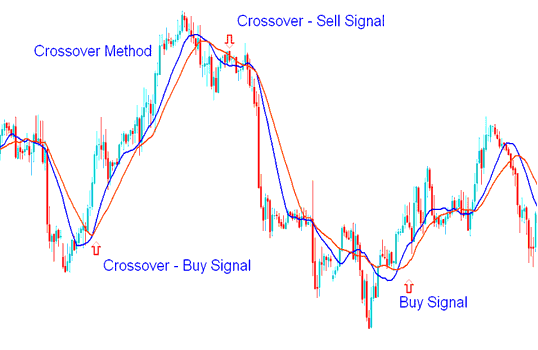

One of the common ways to spot a new Forex trend as fast as possible is to use Moving Averages Indicator. A simple strategy is to use a moving average crossover system that will identify a new trading opportunity at its earliest stage.

Moving Average Crossover Technique

Sell signal and Buy signal Generated by Moving Average Crossover Trading Method

3. Choose additional indicators to confirm the forex trend

Once we find a new forex trend we need to use additional indicators that will confirm the entry forex trading signals & give either a green light for action or save a trader from fake-outs.

To confirm the forex trading signals we use RSI indicator and Stochastic Oscillator technical indicator.

RSI Indicator and Stochastic Oscillator Indicator Trading System

4. Finding entry and exit points

Once technical indicators are chosen so that one indicator gives the trading signal and another indicator confirms the signal, it's time to enter a forex trade transaction.

A trader should enter a forex trade as soon as a trading signal is generated & confirmed after a candlestick closes.

Aggressive traders enter a trade transaction immediately without waiting for the current price bar to close.

Other traders wait until the current price bar is closed and then enter the trade transaction if the trade setup has not changed and the forex signal remains valid after the price bar has closed. This method is more considerate and prevents additional false entries and fakeout whipsaws.

Generating Forex Signals - how to Generate Trading Signals.

Generating Trade Signals

For exits, a trader can either set an amount that wants to earn per trade or use technical tools that help to set profit target goals like Fibonacci expansion tool or set a protective stop loss depending on the market volatility at any given time. Alternatively a trader can exit when the indicators give an opposite trading signal.

When opening a new trade transaction it's always important to calculate in advance how much you are willing to lose if the trade goes against you. Although the goal is to create the best Forex system in world, losses are inevitable & therefore being ready to tell where you'll give up & cut your losses before starting a trade transaction is very important.

5. Calculate risks in each trade setup

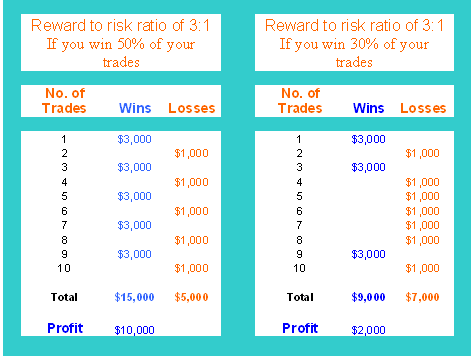

In Forex, you must calculate your risk for each trade. Serious traders will only enter & look to open an order if the risk to reward ratio is 3:1 or more.

If you use a high risk to reward ratio like 3:1, you significantly increase your chances of becoming profitable in the long run.

The Risk to Reward Chart below shows you how:

Money Management Reward Risk Chart - Money Management Methods Risk : Reward Ratio Explained

In the first examples of Risk-:-Reward Ratio, you can see that even if your trading system only won 50% of your trades, you would still make profit of $10,000. Read more on this money management topic: Here Money Management Rules and Money Management Rules Discussed.

Before opening a new trade, a trader should define the point at which they will close the trade if the trade turns to be a losing forex trade. Some traders use Fibonacci retracement levels tool and support and resistance levels. Other traders just use a pre-determined stop loss to set stop loss orders once they have opened a FX trade transaction.

6. Write down the forex systems trading rules & follow them

A Forex Trade System refers to a set of trading rules that you follow to manage your trades.

The keyword is A SET OF TRADING RULES which you must follow. If you don't follow the rules then you don't even have a forex trading system in the first place.

The next Forex trading systems lesson shows you an example of how to use the above steps to come up with your own forex online trading system:

Next Guide: Example of Writing Forex Trade Systems Rules

7. Practice on a Forex Demo Account

Without enough trades, you will not be able to realize the true profitability of your Forex trading system.

Once you have your Forex trading system rules written, it's time to test & improve your trade system by using it on a forex practice trading account.

Open a free practice trading account & trade your forex system to see how well it will respond.

It is strongly recommended to start with a forex practice account and practice for at least for 1 or 2 months so as to gain some practice and experience on how the forex trading market works.

Once you start making some decent profit on your forex demo account you can then try opening a live forex account & begin trading with real money.