How to Calculate Leverage (Gearing) and Margin

The definition of Leverage is having the ability to control a large amount of money using very little of your own money and borrowing the rest. - this is what makes the currency market to attract many investors.

Example:

We shall us this example to explain what this is? If your broker gives you leverage of 100:1 (this is best option to select as a maximum for any account)

This means you borrow $100 for every dollar you have in your forex trading account.

To put in another way your broker gives you $100 for each one dollar in your trading account. This is what is referred to as leverage, also known as gearing.

This means if you open an account with $10,000 and your leveraging is 100:1, then you will get $100 for every $1 you that you have, the total amount that you will control is:

If for 1 dollar the broker gives you 100

Then if you have 10,000 you will get a total of:

$10,000 * 100 = 1,000,000 dollars

Now you control 1,000,000 dollars of Investment

Most new forex traders ask what leverage is best for 10,000 dollars, or 20,000 dollars, or 50,000 dollars account? - The best option to select when opening a live forex account is always 100:1 and not 400:1.

What's FX Trading Margin?

This is the amount of money required by your broker so that to allow you to continue trading with borrowed amount.

In other words the question what's margin in Forex? can be described as the money required to cover open currency trades & is expressed in percentage. For 100:1, the amount you will control is 1,000,000 dollars as explained in the above example.

Now can you compare someone investing $10,000 with another one investing $1,000,000? Obviously Not. This is how it works, it takes you from that guy investing $10,000 to that one investing $1,000,000 or that one investing $50,000 to that one investing $5,000,000. Where does this extra money come from? You borrow from your broker in what's simply referred to as Leverage or Gearing. This money that you borrow, you borrow it against the $10,000 dollar of your own that you deposit with your broker. If you were to explain what this means - then it is the ability to control a big amount of money using very little of your own money and borrowing the rest. Otherwise, if you were trade Forex without this gearing it would not be as profitable as it is, in fact you can still choose not to use it, using the 1:1 option but you would not make money it would take too long to make any profit.

Example of how to calculate:

Margin required in this case is 10,000 dollars (your money) if it is expressed as a percent of 1,000,000 dollars which you control it is:

If leverage = 100:1

10,000 / 1,000,000 * 100= 1%

Margin required = 1 percent

(1/100 *100= 1%)

"TradeForex Trading - Please simplify because I am Beginner'

(Simplify - your capital is $10,000 after gearing you control $1,000,000 - $10,000 is what percent of $1,000,000 - it is 1%) that is your margin requirement.

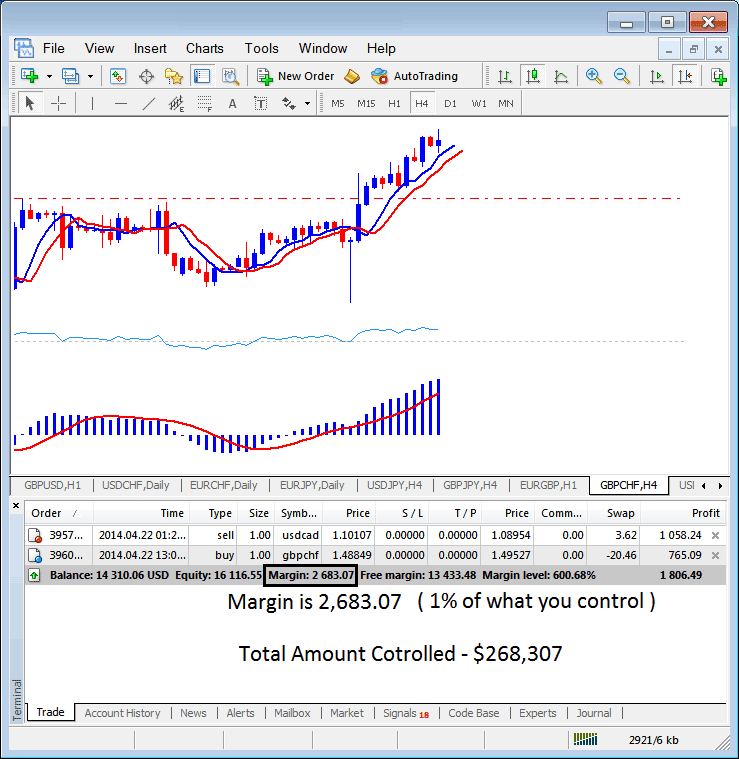

The example below, the set trading leverage is 100:1 ratio option, the trading margin which is 1 % is $2683.07, therefore the total amount controlled by trader is: $268,307 - this is because with this gearing the trader has used little of his money and borrowed the rest of the amount, with this set at 100:1 ratio option, the trader is using 1 percent of their trading account capital, this 1% is equivalent to $2683.07, if 1 percent is equal to $2683.07 then 100 % is $268,307

MetaTrader 4 Transactions Window

- If = 50:1

Then margin requirement = 1/50 *100= 2%

If you have $10,000,

10,000* 50 = $500,000.

10,000 / 500,000 * 100= 2%

(Simplify - your capital is $10,000 after gearing you control $500,000 - $10,000 is what percent of $500,000 - it is 2%) that is your margin requirement

- If = 20:1

Then the requirement = 1/20 *100= 5 %

If you have $10,000,

10,000* 20 = $200,000.

10,000 / 200,000 * 100= 5%

(Simplify - your capital is $10,000 after gearing you control $200,000 - $10,000 is what percent of $200,000 - it is 5%)

- If = 10:1

Then the requirement is = 1/10 *100= 10 %

If you have $10,000,

10,000* 10 = $100,000.

10,000 / 100,000 * 100= 10%

(Simplify - your capital is $10,000 after gearing you control $100,000 - $10,000 is what percent of $100,000 - it is 10%)

What's Difference Between Maximum Forex Trading Leverage & Used FX Trading Leverage?

However, you should note that there is a difference between maximum (leveraging given by your broker which is the highest leverage you can trade with if you choose to) & used (leveraging depending on the lots you have opened/open trades). One is broker's (Maximum) and other is trader's (Used). To explain this concept we shall use example above:

If your broker has given you 100:1 Maximum Gearing, but you only open trading lots of $100,000 then Used Gearing is:

100,000 : $10,000 (your money)

10:1

Your have used 10:1, but your maximum is still 100:1. This means that even if you are given 100:1 Maximum or 400:1 Maximum, you do not have to use all of it. It is best to keep your used leverage to a maximum of 10:1 but you will still select 100:1 maximum option for your account. The extra gearing will give you what we call Free Margin, As long as you have some Free margin on your account then your trades will not get closed by your currency broker because this requirement will remain above the required level.

When it comes to trading currencies one of your rules: money management rules on your trade plan should be to use below 5:1.

In the above image example, trader is using $2683.07, total controlled amount is $268,307, but account equity is 16,116.55, therefore used leverage is ($268,307 divide by 16,116.55) = 16.64 : 1

16.64 : 1

Margin accounts allows traders to control a large amount of currency using little of their own while borrowing the rest

Obtaining this account will enable you to borrow money from the broker to trade currency lots with; the lots are worth $100,000.

The amount of borrowing power your trading account gives you what is called "leverage", & is usually expressed as a ratio - a ratio of 100:1 leverage means you can control resources worth 100 times your deposit amount.

What this means in Forex terms is that with 1 % margin in your account you can control one standard lot/1 contract worth $100,000 with a $1,000 deposit.

However, Trading this account increases both potential for profits as well as losses. In Forex you can never lose more than you invest, losses are limited to your deposits and usually brokers will close a trade which extends beyond your deposit amount by executing a margin call. Traders must therefore try to keep their margin level above that required. By using money management rules & keeping your used leverage below 5:1, then as a trader can learn how to manage this.

Update: in Forex you can lose more than you deposit with some brokers, that is why when opening an account you should look for a Negative Balance Protection Policy(NBP), this policy means you cannot lose more than you deposit.

Benefits

As mentioned above, this type of account gives you more buying power and the potential for more profits or losses. How this works is; a 1% margin allows you to control a position size of $1,000,000 with $10,000. When you open a transaction with $1,000,000 small market changes in the price of the currency can result in large profits or losses.

Currencies movements are measured using points known as pips. For example, USA dollar, is transacted in units down to 4 decimal places, the last decimal place is called a pip. Instead of $1.4 quotes like in Forex bureaus, the price is seen as $1.4012. When you are trading $1,000,000 then each pip is worth $100 profit. So if this price moves up 1 pip to $1.4013 you will make $100 profit. 1 cent is equal to 100 pips, if a currency moves 1 cent you make $10,000 dollars, if this move is against you, then you lose all your capital. That it is not best to open positions with $1,000,000 just because you can, but you can open transactions of $50,000 or $100,000 as the maximum so that a 1 cent move you will make $1,000 dollars and if the move is against you only lose $1,000 dollars and not your whole account equity. There is also the method of money management and risk management.

If price changes from 1.4012 to 1.4062 which is a difference of 50 pips which represents a profit of $5,000. Without gearing if you had $10,000 of currency, the price change from 1.4012 to 1.4062 represents a difference of $50 profit. So the benefit of this online trading is increased profit potential, your profit factor is multiplied by 100 or by 50 or by 20 depending on the total gearing used.

You do not need a calculator for these calculations, these levels are calculated and displayed by many of the currency platforms, for example in MetaTrader 4 these levels are shown under the transactions window (Press CTRL+T on your keyboard to access it while your MT4 is open) these levels are displayed, just below your open transactions.