Creating a Forex System - 4 Example Trading System Templates - MetaTrader 4 Templates Example Systems

When creating your own forex system, there are a few things to keep in mind. Your forex strategy needs to be able to identify new forex market trends, while at the same time making sure you do not to get faked out/whipsaws. The real trick is, once you have created a forex trading system that works for you, stick to it. Being disciplined will help you a lot in becoming successful in forex trading.

Before trading forex on a live forex trading account, you have to figure out what trading strategy works for you. It's good to know in what chart timeframe you're going to be working in, & how much you're willing to risk once you start forex trading online. All these factors should be factored in, and should be written down within your trading plan. A good place to test this forex trading plan would be on a free demo trading account. This is where you test your strategies risk free without investing money to determine which strategy is best suited for you.

So, now how can a trader like you create a "good forex trading system" or the "best forex trading system"?

To come up with a good trading strategy the first thing to do is to define your objective or goal:

The following examples illustrates a goal and explains the rules of how to achieve that goal

Goals - Trading System Goals

1. Identify a new forex trend

Moving average crossover method forex trading strategy is most oftenly used strategy to identify a new forex trend. Time to open a long or short trade is determined when 2 moving averages indicators cross over or cross under each other.

2. Confirm the new forex trend

Relative Strength Index(RSI) Indicator and Stochastic Oscillator Indicator are the most commonly used technical indicators to confirm a Forex trend.

Indicator based Trading System

The best type of a forex trading method is one that is indicator-based. You will find it straight forward to generate the forex signals & thus less error-prone on your part & this will help you to avoid market whipsaws.

There are several things we want to achieve when creating a system:

- Find entry points as early as possible.

- Find exit points securing maximum gains.

- Avoid fake entry & exit signals.

- Proper Money Management Rules

Accomplishing these 4 goals will result in a profitable forex strategy that works.

The last piece of information needed, is deciding how aggressive you are going to be when entering and exiting a forex trade. Those traders who are more aggressive wouldn't wait until the forex chart candle closes and would enter as soon as their technical indicators match up. But most traders would wait until the forex chart candlestick of the chart timeframe they are using has closed, to have more stability when entering a the market.

To get profits out of the forex market you need to build your own profitable trading system: a trading technique that will generate profitable forex signals. You need to have your own strategy that will help you achieve your financial goals. Sometimes the best trading systems are the ones that you build on your own. No need to keep searching online for best Forex systems or for trading systems that work, this site provides you with all the forex tools required to help you and guide you on how to create your own forex trading systems.

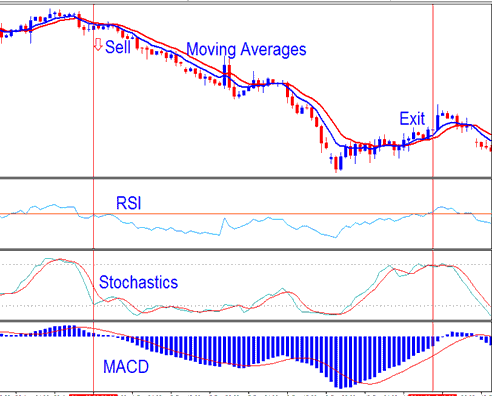

Shown Below is example of a forex trade system based on RSI, MACD & Stochastic.

Forex System - MetaTrader 4 Templates Example Systems

The trading system example above is comprised of four technical indicators in total, all of these generate trade signals using different methods, the moving average will generate forex signals using the moving average crossover method shown, the RSI indicator, Stochastic indicator & MACD indicator use different technical analysis to generate the long and short signals as shown in the above example. How to generate these forex signals is discussed in the next topic (on the sidebar navigation learn forex lessons menu under key concepts).

For beginner traders, it is difficult for them to create their own Forex strategies since they do not have a lot of knowledge about the FX market. However, this learn forex trading web site will explain how a beginner trader can create their own free trading system in just seven easy steps. Best strategy is one you come up with yourself and learn how to trade the forex market with it.

The main advantage of creating your own free trading systems is that you will know how to trade with it and make profits by yourself - and not rely on other peoples efforts.

In the next lesson located at the sidebar navigation learn trading lessons menu below the forex key concepts will show you how to create a forex trading system like the one above, write it's forex rules & how to back-test the system on a practice forex practice account before using it on a live forex trading account.

4 Examples of Free Forex Trading Systems - MT4 Examples Trading Systems

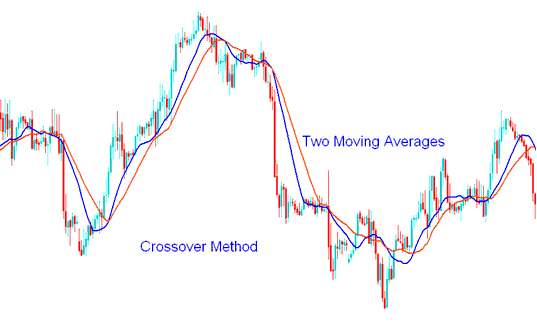

Example 1: The Moving Average Crossover Method

The moving average indicator cross over method uses two moving averages to generate forex signals. First Moving average uses a shorter period and the second is a longer period moving average.

Moving Average Crossover Technique - Moving Average Crossover Strategy

This above trading method is referred to as the moving average crossover method because forex trading signals are generated when 2 averages cross above or below each other.

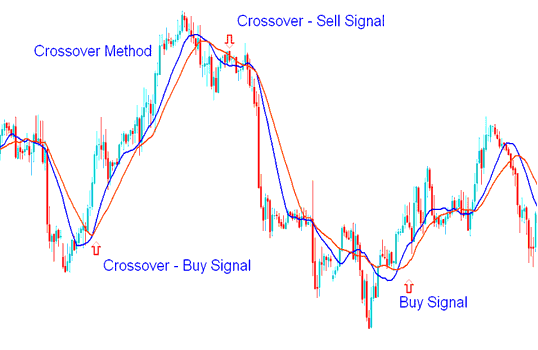

Forex System Trading Example - Short and Long trading signal Generated by Trading System

A buy signal or going long trade is generated when the shorter moving average indicator crosses above longer moving average indicator (Both Moving Averages Going Up).

A sell signal or a going short trade is generated when the shorter average indicator crosses below longer moving average indicator (Both Moving Averages Moving Down).

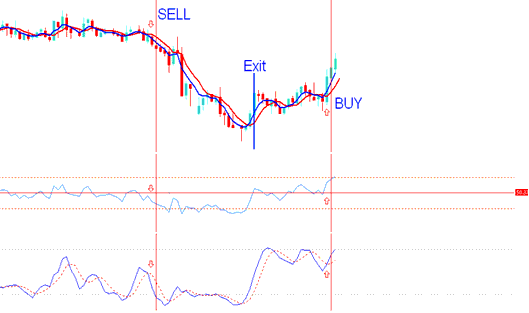

Example 2: Stochastics Forex System - MetaTrader 4 Templates Example Systems

Stochastic Oscillator technical indicator can be combined with other indicators to form a trading system.

- RSI indicator

- MACD indicator

- Moving Averages forex indicators

Trading Systems Example - MetaTrader 4 Templates Example Systems

Short Signal or Sell Signal

How the short sell signal was generated

From our forex trading rules the short sell signal is generated when:

- Both Moving Averages are heading down

- RSI is below 50

- Stochastic moving downward

- MACD heading downwards below centerline

The short signal was generated when all the written forex rules were met. The exit signal is generated when a forex trade signal in opposite direction is generated.

The good thing about using such a trading method is that we are using different types of technical indicators to confirm the forex signals & avoid as many whipsaws as possible in the process.

- Stochastic - forex momentum oscillator indicator

- RSI - forex momentum oscillator indicator

- Moving Averages Technical Indicator - forex trend following indicator

- MACD - forex trend following oscillator

Based on the chart time frame used - this strategy can be used as Forex scalping system when the minute charts are used or as a day system when hourly charts are used.

Example 3: System Forex Trading Example

This system is fully described within the trading plan on the trading plan tutorial on this learn forex website under the key concepts section located on the right navigation menu.

Chart Time Frame

1 hour chart

Trading Indicators which identify a new forex trend

Moving Average Crossover Trading Indicators Strategy

Indicators which confirm the forex trend

RSI indicator

STOCHASTIC OSCILLATOR indicator

Long Entry - Buy Signal

1. Both MA(moving averages) pointing up

2. RSI above 50

3. Both stochastics going up

Short Entry - Sell Signal

1. Both MA pointing down

2. RSI below 50

3. Both stochastics going down

Exit Signal

1. MA Indicator gives opposite signal

2. RSI gives opposite signal

Risk Management in FX Trading

Stop Loss - 35 pips

Take Profit - 70 pips

Reward to Risk 2:1

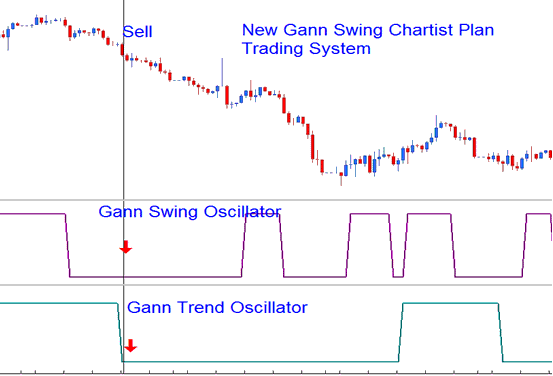

Example 4: New Gann Swing Chartist Plan - MetaTrader 4 Templates Example Systems

The Gann Swing Oscillator is meant to be used in combination with the Gann HiLo Activator and Gann Trend to form a complete strategy commonly referred to as the - "New Gann Swing Chartist Plan". Within this methodology the Gann Swing Oscillator is used to help determine forex market swings for trading only within the current market trend is illustrated by the Gann Trend.

Shown Below is examples of New Gann Swing Chartist Plan

The Gann Chartist Plan - MT4 Template Trading System