Linear Regression Technical Analysis & Linear Regression Signals

Another name for a regression line is a line of the best fit/best fit line. This indicator plots the trend of the currency price over a specified duration of time. The market trend is determined by calculating a Linear Regression Trend Line using the "least squares fit" method. This method helps to minimize the distance between the price data points and the line of best fit.

Unlike the straight Regression Trend Line technical indicator, the technical indicator draws the end values of multiple Linear Regression trendlines. Any single point along the Linear Regression will be equivalent to the end value of a Regression Trend Line, but the resulting trend line looks like the Moving Average.

But unlike the Moving Average, this indicator doesn't show as much delay since it is fitting a line onto data points rather than averaging them.

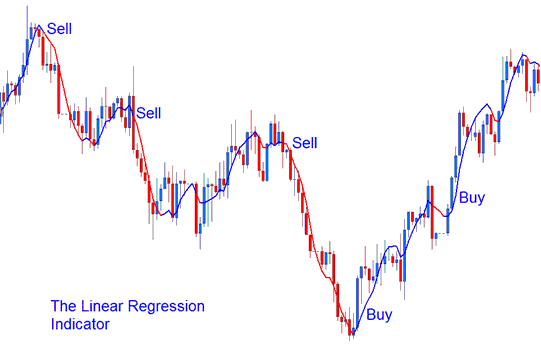

The Linear Regression is a prediction of the tomorrow's price plotted today, one day before. When the prices are steadily higher or lower than the forecast price, then a trader can expect them to quickly return to more realistic fore-casted levels.

In other terms, this indicator shows where the chart prices "should" be trading based on a statistical basis & any disproportionate deviation from the regression line is likely to be short-lived.

Forex Technical Analysis & Generating Signals

This indicator allows for price selection, adjusting number of periods and smoothing of price data before applying the calculation and the selection of smoothing type.

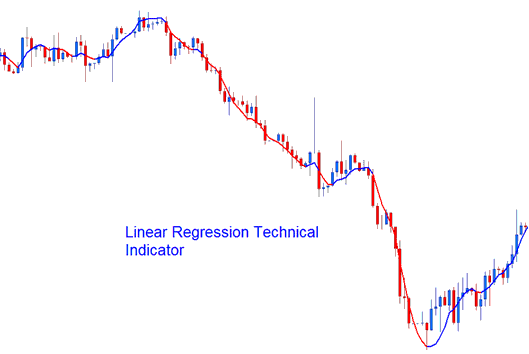

This technical indicator looks like a moving average but it has a bi-color representation.

- Bullish Signal (Blue color) - A rising line (greater than its previous value 1 previous bar before) is displayed in the up trend blue color, while

- Bearish Signal (Red color) - a declining line (lower than its previous value 1 previous bar before) is displayed in the down trend red color.

Technical Analysis in FX Trading