MACD Forex Trading Technical Analysis Signals

Created by Gerald Appel,

The Moving Average Convergence/Divergence is one of the simplest, reliable, and most commonly used indicators.

It is a momentum oscillator & also a trend-following indicator.

Construction

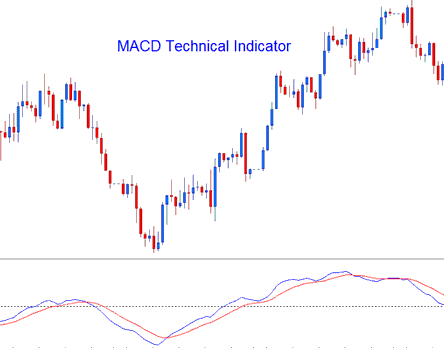

The construction of this indicator calculates the difference between two moving averages and then plots that as the 'Fast' line: the a second 'Signal' line is then calculated from the resulting 'Fast' line and then drawn on the same panel window as the 'Fast' line.

- 'Fast' line - Blue Line

- 'Signal' line - Red Line

The 'standard' MACD values for the 'Fast' line is a 12-period exponential moving average & a 26-period exponential moving average & a 9-period exponential moving applied to the fast line, this plots 'Signal' line.

- Fast-line = difference between 12 & 26 exponential moving averages

- Signal Line = moving average of this difference of 9-periods

Forex Technical Analysis & How to Generate Signals

The MACD is oftenly used as a trend-following indicator and works most effectively when interpreting trending market movements. 3 common techniques of using MACD to generate signals are:

Forex Crossovers FX Trading Signals:

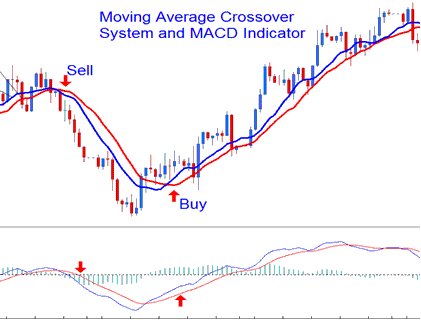

Fast-line/Signal-line Crossover:

- A buy trading signal is generated when Fast Line crosses above Signal Line

- A sell trading signal is generated when FastLine crosses below Signal Line.

However, in a strong trending market this signal gives a lot of whipsaws, the best cross-over to use would thus be the Zero Line Crossover Signal that is less prone to whipsaws.

Zero Line Crossover Signals:

- When the Fast Line crosses above zero center line a buy signal is generated.

- when the FastLine crosses below zero center line a sell trading signal is generated.

Forex Divergence FX Trading:

Looking for divergences between the MACD and price can prove to be very effective in spotting the potential reversal and/or trend continuation points in price movement. There 2 types of divergences:

- Classic Divergence Signals

- Hidden Divergence Signals

Overbought/Oversold Conditions:

MACD indicator is also used to spot potential overbought-oversold conditions in price action movements.

These levels are generated if the shorter MACD Lines separate dramatically from the median, this is an indication that price action is over-extending & it will soon return to more realistic levels.

MACD and Moving Average FX Crossover Forex Trading System

This indicator can be combined with others to form a Forex system. A good combination with the Moving Average crossover system. A trading signal is generated when both give a signal in same direction.

Technical Analysis in FX Trading