Types of MAs Moving Averages - SMA, EMA, LWMA & SMMA

There are 4 types of MAs:

- Simple moving average

- Exponential moving average

- Smoothed MA

- Linear weighted moving average

The variation among these four Moving Averages is determined by the weight allocated to the most recent price information.

Simple Moving Average - SMA Indicator

The Forex SMA indicator assigns equal importance to all data points used in calculating the simple moving average: this is computed by aggregating the price values over a specified number of chart periods and then dividing this sum by that same period count. For example, a 10-period simple moving average sums the price data for the last 10 price bars and divides the total by 10.

Exponential Moving Average - EMA Indicator

The Forex EMA gives more weight to recent prices. It uses a percent multiplier to stress the latest data points.

Linear Weighted Moving Average - LWMA Indicator

Forex LWMA indicator moving averages(MAs) applies more weight to the most recent price data and the latest data is of more value than earlier price data. Linear Weighted MA(Moving Average) is calculated by multiplying each of the closing price within the series, by a certain weight coefficient.

Smoothed Moving Average(MA) - SMMA Indicator

The Forex SMMA Indicator works by applying a smoothing factor of N, meaning it smooths out N price bars over N periods.

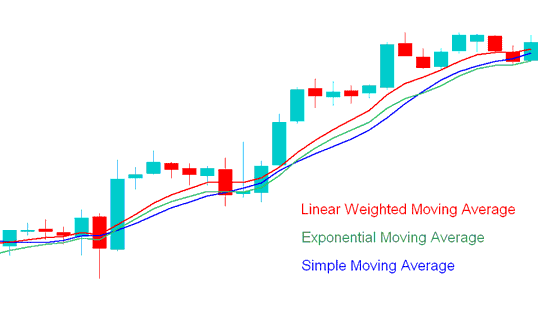

The subsequent chart displays representations of the SMA, EMA, and LWMA averages. The SMMA moving average is omitted from this illustration due to its less frequent usage.

The LWMA indicator responds most rapidly to shifts in price data, followed by the EMA, and then the SMA is the slowest.

SMA, LWMA, EMA - Types of Moving Averages - SMA, EMA & LWMA

Day Trading with Exponential and Simple Moving Averages

The Simple Moving Average (SMA) and Exponential Moving Average (EMA) are the most frequently employed Moving Averages in forex trading. Despite the EMA possessing a more intricate calculation methodology, it retains greater popularity compared to the SMA MA.

The arithmetic average of closing prices over the chosen time frame is known as simple MA. The price period is based on the set time frame, where each time frame period is added and then divided by the number of price periods chosen. The used price period is 10, which is calculated by summing the last 10 periods and dividing by 10.

The SMA comes from a basic average of prices. It tracks trends well by hugging the price closely, which some traders like.

Conversely, the EMA incorporates an acceleration factor, rendering it more responsive to current trend changes.

The SMA moving average helps to look at and understand what prices are doing on charts. If the price moves for more than 3 or 4 periods, the SMA says to quickly end long trades because the upward push of buying is getting weaker.

The shorter the SMA price period the faster it's to respond to price change. SMA technical indicator can be used to illustrate direct information regarding the trend of the price and the strength by looking at its slope, the steeper or more pronounced the slope of the SMA is, the stronger the trend.

Many traders also use the Exponential MA in the same way, but it changes faster with the market, so some traders like it more.

The SMA and EMA can also be used to generate entry and exit points when forex trading. These Moving Averages can also be combined together with Fib & ADX indicators to generate confirmation the trading signals derived & generated by these moving averages.

Obtain Further Instructional Material & Programs:

- IBEX 35 Technical Indicator MetaTrader 4 Indicators

- Developing a Strategy for CHF SGD

- Nikkei225 Strategies Course Download

- What is SMI20 Strategy?

- DeMark Range Extension Indices Gold Indicator Analysis

- Templates on the Charts Menu on MetaTrader 4 Software Platform

- How Can I Find MT4 FTSE MIB 40 Stock Indices Trade Chart?

- Bollinger Band Trading Indicator in Indices Trade Chart Analysis