Moving Average Crossover Day Stocks Trading Strategies

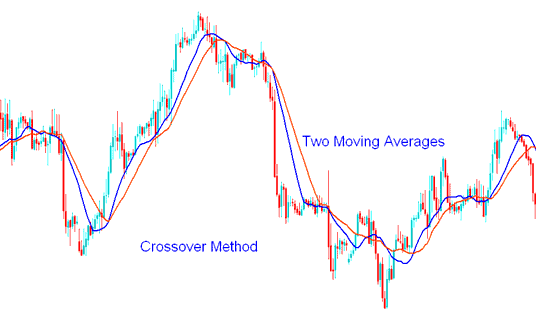

The moving average crossover strategy uses two moving averages to generate stocks trading signals. The first Moving average uses a shorter period and the second moving average uses a longer period.

Moving Average Crossover Day Stocks Trading Strategies - Best Stock Trading Moving Average Crossover for Intraday Stock Trading - Best Moving Average Crossover for Swing Trading

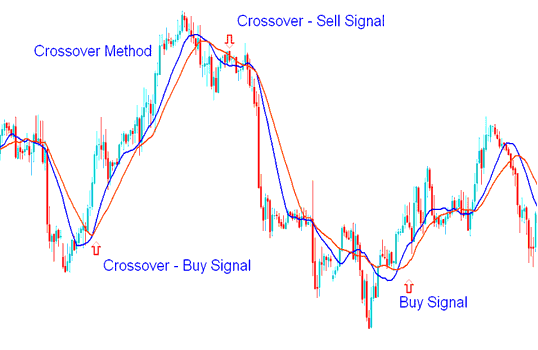

The example moving average crossover strategy above is referred to as the moving average crossover strategy because stocks signals are generated when the two moving averages crossover above or below each other.

Best Moving Average Crossover Stock Day Stock Trading Strategies - Best Moving Average Crossover Intraday Stocks Trading - Best Moving Average Crossover Swing Stock Trading

A buy stocks signal is generated when the shorter moving average crosses over above the longer moving average indicator - Both Moving Averages Going Up.

A sell stocks signal is generated when the shorter average crosses below the longer moving average indicator - Both Moving Averages Going Dow).

Creating Best Moving Average Crossover Day Stocks Trading Systems

When creating your own Moving Average Crossover Stocks Trading System, there are a few factors to keep in mind. Your stocks system needs to be able to identify new stocks trends, while at the same time make sure you do not to get faked out signals -whipsaws stocks signal. Once you have created a stocks system that works for you, stick to its stocks rules. Being disciplined when following your stocks system will help you a lot in becoming successful in stocks.

Before trading Stocks Trading on a live stocks trading account, you have to figure out what stocks strategy works for you. It is also good to know what stocks chart timeframe you are going to be trading with, and how much you are willing to risk once you begin stocks. All these factors should be factored in and should be written down within your stocks plan. A good place to test out this stocks strategy and stocks plan would be on a free practice demo stocks trading account. This is where you test your stocks system and stocks strategy risk free without investing money so as to determine which stocks strategy is best suited for you.

To come up with the "best stock trading system" for your trading style - the first thing to do is to define the objective or goal of your stocks strategy:

The stocks trading strategy example illustrated and explained below shows a goal and explains how to write an example goal for your stocks strategy

Stocks System Goal

1. Identify a new stocks trend

Moving average crossover strategy moving average crossover stocks strategy is the most commonly used stocks trading strategy to identify a new stocks trend.

2. Confirm the new stocks trend

RSI Stocks Trading Indicator and Stochastic Stocks Indicator are the most commonly used stocks technical indicators to confirm a stocks trend.

Best Moving Average Crossover Day Stocks Trading Strategies - Best Stock Trading Moving Average Crossover for Intraday Stock Trading - Best Moving Average Crossover for Swing Stocks Trading - Best Moving Average for Stocks Strategy