Potential Breakout Stocks Indicator

Pivot Support Resistance Indicator MT4 is a set of indicators used to determine potential turning points or potential stocks trading breakout points, also known as "pivots" or pivot point. These Pivot Support Resistance Levels are calculated to determine points which the stocks trend could change from "bullish" to "bearish or from "bearish" to "bullish." Stocks traders use these Pivot Support Resistance Levels as zones of support resistance.

These Pivot Support Resistance Levels are calculated as the average of the high, low and close from the previous session:

Stocks Trading Pivot Point = (High + Low + Close) / 3

Stocks Trading day traders use the calculated pivot support resistance levels to determine levels of entry, stop loss level and profit taking level, by trying to determine where the majority of stocks traders may be doing the same thing.

A pivot point is a stocks price level of significant stock trading technical analysis that is used by stocks traders as a predictive or leading indicator of stocks price movement. Pivot Support Resistance Indicator is calculated as an average of significant stocks prices (high, low and close stocks price) from the stocks market prior trading period. If the stocks prices in the following trading period trade above the central pivot point it is interpreted as a bullish stocks trend, whereas if stocks price trade below the central pivot point is interpreted as bearish.

The central pivot point is used to calculate additional levels of support resistance, below and above central pivot point - by either subtracting or adding stocks price differentials calculated from previous day trading ranges.

A pivot point and the pivot support resistance levels are often turning points for the direction of stocks price movement.

- In an upward stocks trend, the pivot point indicator and the pivot resistance levels - represent a ceiling level for the stocks price - if stocks price goes above this level the upward stocks trend is no longer sustainable and a stocks trend reversal is likely to happen.

- In a downward stocks trend, the pivot point and the pivot support levels may represent a low for stocks price level or a resistance to further stocks price decline.

The central pivot point can then be used to calculate the support resistance levels as follows:

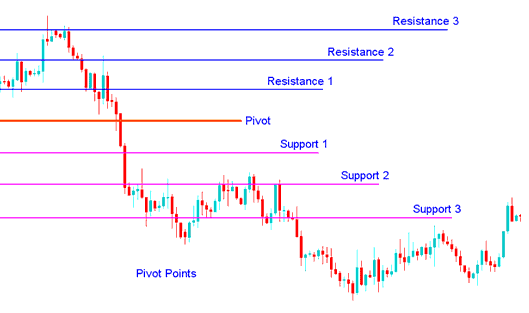

Pivot Support Resistance Indicator MT4 consist of a central pivot point level surrounded by three support levels below it and three resistance levels above it. Pivot Support Resistance Levels provide a quick method for stock traders to get a general idea of how the stocks market will be moving during the course of the day by using a few simple calculations based on the previous stocks price close - Previous Day Close Breakout Strategy and Market Open Trading Strategies.

Pivot Support Resistance Indicator MT4 is considered as a leading stocks indicator rather than a lagging indicator. All that is required to calculate the pivot support resistance levels for the upcoming (current) day is the previous day high, low, and close stocks prices. The 24-hour cycle pivot support resistance levels in this indicator are calculated according to the following formulas:

The central pivot point can then be used to calculate the support resistance levels as follows:

Resistance 3

Resistance 2

Resistance 1

Pivot Point

Support 1

Support 2

Support 3

Potential Breakout Stock Indicator - Pivot Support Resistance Indicator MT4 Stocks Indicator