Stocks Trading Consolidation Breakout Stock Chart Pattern

With Stocks Trading Consolidation Breakout Stock Chart Pattern the stock trading market stocks price breakout can move in any direction.

Symmetrical Triangles Stocks Trading Pattern

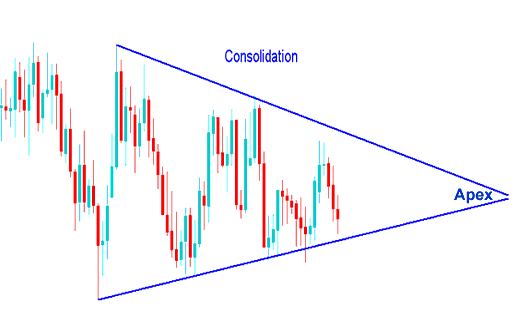

Symmetrical triangles are stocks chart patterns with converging trend lines that form a consolidation period of the stocks price. The technical analysis stocks buy signal from a symmetrical triangle is the upside stocks price breakout, while a downside stocks price breakout is a technical stocks sell signal. Ideally the stock trading market breaks out from a consolidation stocks chart pattern - symmetrical triangle prior to reaching the apex of the triangle.

Stock Trendlines can be drawn connecting the lows and highs of the consolidation stocks chart pattern phase, the stocks trend lines formed are symmetric and converge to form an apex - stocks trading triangle pattern - stocks trading consolidation pattern. A Stocks Trading Consolidation Breakout should occur somewhere between 60-80% into the stocks trading triangle stocks chart pattern. An early or late Stocks Trading Consolidation Breakout is more prone to whipsaw stock trading signals, and therefore less reliable. After a stocks price breakout the apex of the stocks trading triangle forms support and resistance levels for the stocks price. Stocks price that has broken out of the apex should not retrace past the apex of the stocks trading triangle consolidation stocks chart pattern. The apex of the triangle consolidation stocks chart pattern is used as a stop loss stocks order setting area for the open stock trades.

When these stocks trading consolidation stocks chart patterns form we say that the stock trading market trend is taking a break before deciding the next direction to move.

These stocks trading consolidation stocks chart patterns form when there is a tug of war between the buyers and the sellers and the stock trading market cannot decide which way to move.

Stocks Trading Consolidation Breakout Stock Chart Pattern - Stocks Trading Consolidation Breakout Indicator - Stocks Trading Consolidation Stock Chart Pattern Stocks

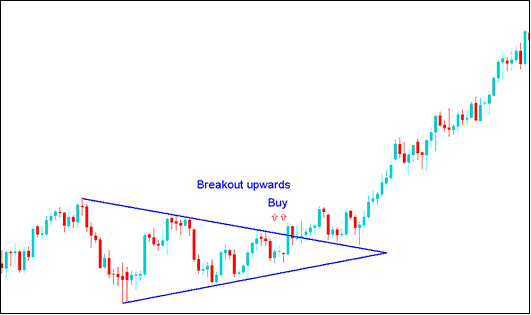

However, this stocks trading consolidation stocks chart pattern cannot go on forever and just like in a tug of war one side eventually wins, looking at the Stocks Trading chart below see how the consolidation eventually had a stocks trading breakout and moved in one direction - Stocks Trading Consolidation Breakout Stock Chart Pattern. Now how do i make sure you choose the winning side?

Stocks Trading Consolidation Breakout Stock Indicator MT4 Stock Trading Platform - Consolidation Indicator Stocks Trading - Stocks Trading Consolidation Indicator MT4 - Stocks Trading Consolidation Stock Chart Pattern Stocks

Stocks Trading Consolidation Breakout Stock Chart Pattern - Stocks Trading Consolidation Breakout Indicator - Stocks Trading Consolidation Breakout Indicator MT4

Now back to our stocks trading question, how do we make sure we are on the winning side of the trade?

Well we wait until the stocks price moves past one of the trend lines of the stocks trading triangle consolidation pattern and put buy stocks orders or sell stocks orders in that direction. If stocks price stocks trading breaks the upper consolidation line we buy, if it stocks price breaks the lower consolidation line we sell.

Alternatively if you do not want to wait for a stocks trading consolidation stocks trading breakout - you can use stocks trading ending orders.