Flat Top Breakout Pattern

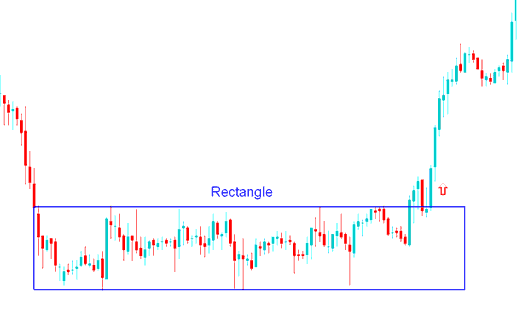

A range stocks trading consolidation stocks chart pattern is a trading range with narrow stocks price action that forms a consolidation period in stock trading market. The stocks range is defined by two parallel stocks trend lines which are horizontal and these trend lines indicate the presence of support levels and resistance levels at this particular area. Range consolidation stocks chart pattern is drawn on a stocks chart using a range, therefore the name stocks trading range stocks trading chart pattern.

For this stocks trading consolidation stocks chart pattern, stocks price forms a series of highs and lows that can be connected with horizontal stocks trend lines that are parallel to each other. Range consolidation stocks chart pattern forms over an extended period of time giving this stocks chart pattern its range shape.

Flat Top Breakout Pattern - A stocks trading breakout of stocks price action from this range consolidation stocks chart pattern occurs when either of the horizontal line is penetrated and the stocks range of this range stocks trading pattern is broken. An upside stocks price breakout is a buy stocks signal. A downside stocks price breakout is a sell stocks trading signal.

Flat Top Breakout Pattern - How to Trade Stocks Trading Breakouts - How to Identify Stock Trading Breakout Pattern - Stocks Trading Breakout Pattern Strategy

Stocks Price Breaks Out of the range consolidation pattern after a period of time and stocks price continues to move upwards after an upwards stocks price breakout.

Flat Top Breakout Pattern - How to Trade Stocks Trading Breakouts