Drawing Fibonacci Retracement Areas on Upward and Downward Trend

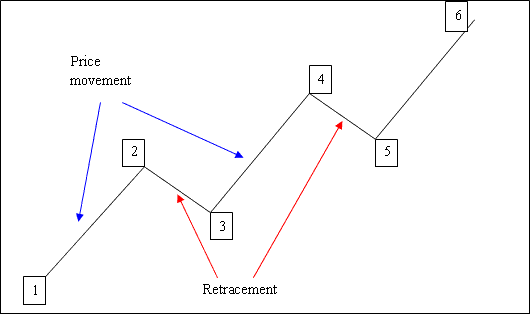

The stocks price on a stocks chart does not move up or down in a straight line. Instead it moves up or down in a zigzag pattern. Stock Fibonacci Retracement is the tool used to calculate where the zigzag will stop. The pullback levels are 38.2%, 50% and 61.8%. These form the points at which the stocks market is likely to make a retracement.

What's a retracement? It is a pullback of the stocks price before the stocks market resumes the original trend/original direction of movement.

Examples of Zigzag Movement: The Example below shows stocks price moving up in a zigzag pattern.

The diagram below shows movement in an upward market.

1-2: Stocks Price moves up

2-3: Pullback

3-4: Moves up

4-5: Pullback

5-6: Moves up

Since we can spot where a pullback starts on a Stocks chart, how do we know where it will reach?

The answer is we use Fibonacci retracement tool.

This is a type of line study used in stocks to predict and calculate these levels. This stocks indicator is placed directly on the stock chart within the trading platform provided by your broker, This stocks indicator will then automatically calculate these levels on the trading chart.

What are The Retracement Levels

- 23.6 %

- 38.2 %

- 50.0 %

- 61.8 %

38.20% & 50.00% Levels are the most used & most of the time this is where the pullback will reach. With 38.20% being the most popular & most widely used.

61.80% is also oftenly used to set stops for trades opened using this strategy.

This tool will be drawn in direction of the trend as described in the examples below.

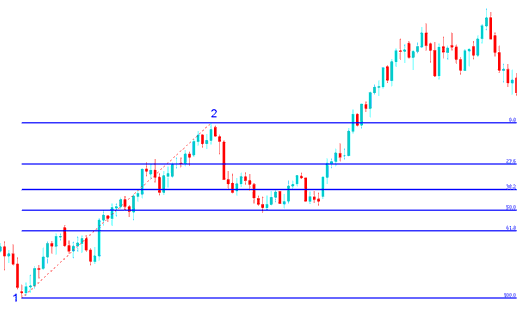

How to Draw on an Upward Bullish Market

In the diagram below the stocks price is moving up between 1 and 2 then after 2 it retraces down to 50.0% pull back area then it continues moving up in the original upward trend. Notice that this indicator is drawn from point 1 to point 2 in direction of the trend (Upward).

Because we know this is just a pull-back based on strategy of using this technical indicator, we put a buy order just between the levels 38.20% & 50.0% and our stop loss order just below 61.80% pull-back mark. If you had put a buy at this point in the trade examples illustrated & explained below you would have made a lot of pips on the trade.

Explanation for the Above Stock Trading Example

Once the trade hit the 50.0 % level, this zone provided a lot of support for the stocks price, & afterward stocks market then resumed the original up stocks trend and continued to move upward.

23.60% provides minimum support and is not an ideal place to place an order.

38.2 % provides some support but stocks price in this example continued to retrace upto the 50% zone.

50.0% provides a lot of support & in this example, this was the ideal place to set a buy order.

For this example, the pull back reached the 50.0% pull back area, but most of the time the stocks market will retrace up to 38.2 % and therefore most of the time traders set their buy limit orders at the 38.2 % level, while at the same time placing a stop just below 61.8 %.

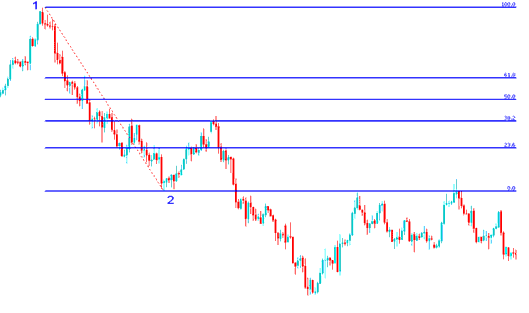

How to Draw on a Downward Bearish Market

In the diagram below the stocks market is moving down between 1 and 2, then after 2 it retraces up to 38.2% retracement then it continues moving down in the original downward trend. Notice that this indicator is drawn from point 1 to point 2 in direction of the trend (Downward).

Because we know this is just a pull back we put a sell order at 38.20% level & a stop loss just above 61.8%.

If you had put sell order at the 38.2% level as displayed on the trade below you would have made a lot of pips afterwards. In this trade the retracement reached 38.20% point & did not get to 50.00% mark. From experience it is always good to use 38.2% because most times the pull-back does not always get to 50.00% mark.

Explanation for the Above Stocks Trading Example

The above example is the perfect setup where the price retraces immediately after touching the 38.20% Level.

This zone provided a lot of resistance for the pull back, this was the best place for an investor to place a sell limit order as the stocks market quickly moved down after hitting this level.