Morning Star Candle Pattern

Morning Star Bullish Stock Candle Patterns

Morning Star Candlestick Pattern

Morning Star Candlestick Pattern

Morning Star Candlestick Pattern

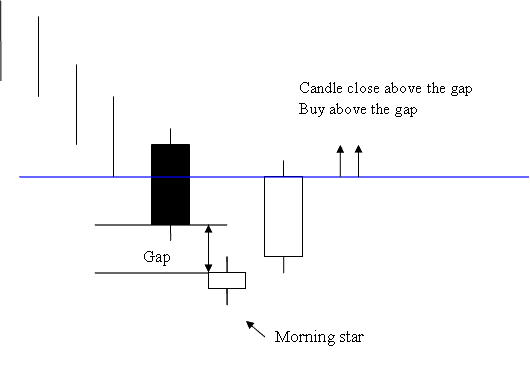

Morning star is a 3 day bullish reversal stocks pattern.

First day is a long black candlestick.

Second day is a morning star which gaps away from the long black candle.

Third day is a long white candlestick which fills the gap.

The filling of the gap & closing of the white candlestick above the gap is a strong bullish Stocks Trading signal.

Traders should open a buy stocks trade after market stocks price closes above the gap formation of the morning star. This is confirmation signal of a buy signal generated by this Morning Star Candlestick pattern.

Evening Star Candle Pattern

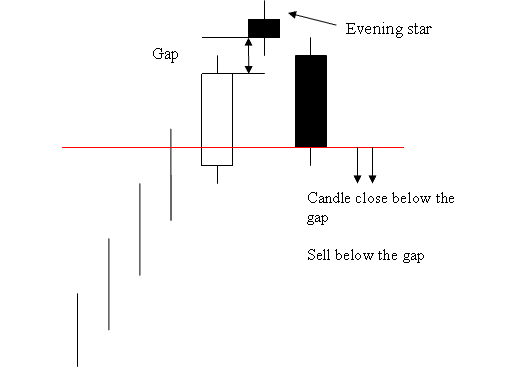

Opposite of the morning star

Evening Star Candlestick Pattern

Evening Star Candlestick Pattern

Evening star is a 3 day bearish reversal stocks pattern.

First day is a long white candle.

The second day is evening star that gaps away from the long white candlestick.

Third day is a long black candlestick which fills the gap.

The filling of the gap & closing of the black candle below the gap is a strong bearish Stocks Trading signal.

Traders should open a sell stocks trade once the stocks market closes below the gap formation of the evening star. This is confirmation signal of a sell signal generated by this Evening star candle pattern.

Engulfing Pattern

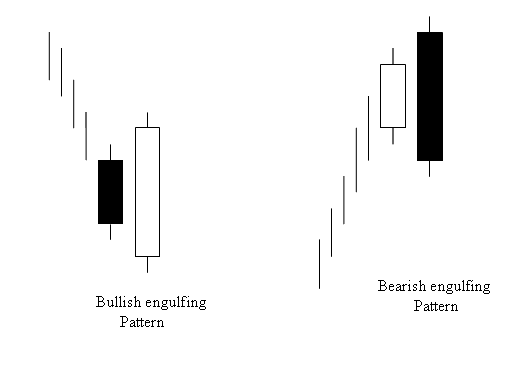

Engulfing is a reversal candlestick pattern which can be bearish or bullish depending upon whether it appears at the end of a market down stocks trend or at the end of a market upwards stock trend.

Bullish and Bearish Engulfing Pattern

Bullish and Bearish Engulfing Patterns

Color of the first candlestick indicates the stocks trend of the day.

The second candle should completely engulf the first candlestick & it should have the opposite color.

For Bullish Engulfing the color of the candlestick should be Blue

For Bearish Engulfing the color of the candlestick should be Red