Momentum Stocks Trends

What is a Momentum Trend?

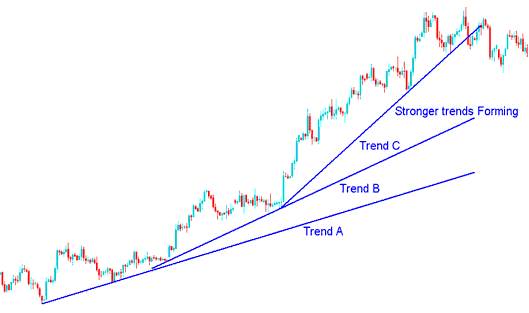

A momentum stocks trend is one that has more momentum than the earlier one, it can be plotted using a much steeper stocks trend line than the one that was in place before. When a new line forms that is more steeper than a previous one we say that the stocks trend has gathered extra strength and becomes much stronger. These types of set-ups require a different type of analysis.

In the stocks example illustrated and explained below: Also when the price is moving up within a channel, if price breaks the up channel a stronger stocks trend is initiated as shown in the diagram below. If as a trader your trading chart breaks an upward stocks trend line to the upward side in an up moving market like the one below, Do not Try to Sell, Buy More Contracts, Remember this stock trading tip it can make you a lot of money just like the way it did in the trading analysis below.

Channel Break Upward - More Momentum on Upwards Market Movement

Using same technical analysis examples above we can also see how the new steeper trend lines were initiated showing the stocks trend was gaining strength.

This is shown by the steeper trendlines that can be portrayed as the stocks price progresses.

The newly shaped stocks trend has more strength than the previous one as displayed by the forming of the steeper trendline.

This forms stocks trend B & C as shown in the diagram below drawn using the MT4 technical analysis software, The momentum added a new steeper line as depicted on this chart.

This is shown in the stocks example illustrated and explained below by the three lines A, B and C showing formation of stronger trends as the stocks market continues to gain momentum.

Stocks Price Gathering More Momentum

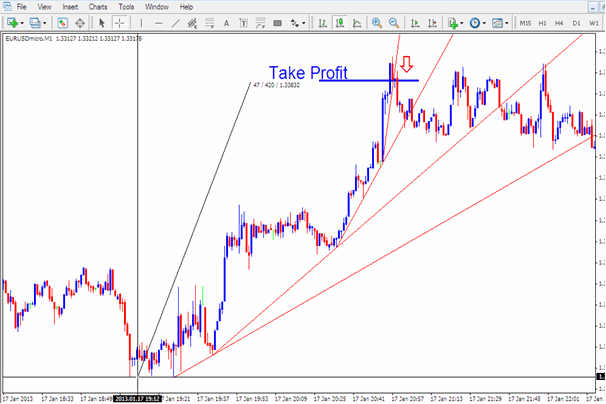

However, when the steepest stocks trendline is broken then even others trendlines will most likely also be broken too. It is best to take profit once the steep most trendline is broken.

This strategy can also be used by short term stocks traders like the day trader or the scalper, this setup will frequently form on the 5 min and 15 minute chart. This parabolic trendlines can be used to know where to set take profit. One should immediately take his profit as soon as the steep most trend line is broken.

How to Trade These

The momentum stocks trendlines are good analysis tools for figuring out where to set take profit early before the other traders. This momentum trading setup occurs frequently on 1 minute, 5 minute and 15 minutes charts & therefore suitable for scalpers & day traders. For day trading which is most common? - the best chart to use is 15 mins sometimes 5 mins, For example after entering a short term trade either buy/sell and the stocks market moves some pips in your favor and you identify this pattern then it's best to exit once the steepest trendline is broken and take profit at that point.

Technical Analysis Example

For this example we shall use the short-term trading chart of minutes for plotting, when the pattern showed up as below, it was a good point to take profit.

Trading The Momentum Market Moves

In the above example one trading long would have waited until the steepest trendline was broken then closed the trade & taking profit at this point thus making a profit of 42 pips on this buy stocks trade. The trader would have exited the trade at the best time & thus avoiding the ranging stock trading market that followed.

Parabolic Trends

Sometimes a market moves in a parabolic manner, & this is seen when panic buying sets in and stocks prices is driven vertical. During a parabolic up move, there is almost a complete absence of bears, which initiates a vacuum of buying. When this occurs traders scramble to just get into the stocks market regardless of stocks price, in the fear of being left behind. This can make the biggest stocks price movements in the shortest amount of time, traders will set buy trade orders in this stocks trading setup.

For this type of move it is best to keep opening buy - no need for analysis just keep opening buy.

This stocks trend will last for even months on end even up to 2 years, for this time just keep buying & as long as those weekly and monthly stocks trend lines are holding just keep buying & buying.

When a stocks instrument moves in this manner, the highest point which is reached often symbolizes end of a move with stocks prices not going back to the ultimate peaks again for a long time. When this level is reached and the most steep most stocks trend line is broken it's best to consider that as a stocks trend market reversal & it is best to take time out off the stocks market and enjoy your profits for a while before calculating **what's your next move.

The same can also happen for a down stocks trend when there is panic selling and stocks price is also driven vertical. This especially happens during recession.

The steeper a stocks trend line angle, the less dependable it becomes. When the most steep is broken its best to exit this trade transaction. The example illustrated and explained below is for crude oil that has shaped a parabolic setup. Another example is stocks that formed on the weekly/monthly chart during the period shortly after the steepest line in the crude oil chart was broken.

As a trader if you happen-to come across a parabolic stocks trend in an upward trend just keep opening buy and buying some more & you will more likely to make profits trading this direction, there will be no added technical analysis requirement just the trend lines. The one thing to remember is to exit once the steep most line is over because the reversal on this stocks pattern is very quick you need to also be very fast. Just make sure that you get out at the correct spot just like in the above example.

For example, the above parabolic movement is of crude oil trading chart, the traders had dominated to drive the stocks price of oil from $70 to $150 over a period of a couple of months and at the top of the stocks market those who call themselves market analysts were so bullish they predicted the stocks price of oil would get to a high of $200, what these analysts did not know this concept a.k.a Vacuum buying, in technical analysis market trading as long as the trendlines held the trend of the market was upward, but even after the first steepest trendline was broken the market analysts still kept insisting the stocks price would hit $200, guess what, after the most steep trendline was broken it did not even take two weeks to take the stocks price of oil, back to $50 at sometime it was even $35. That is parabolic analysis, now-you-knownow-you're-informed.

Good examples of this stocks pattern on charts is the weekly & monthly stocks price charts for Stocks Trading and Crude Oil, these charts can be found on MT4 stock platform depending on your online broker.