How to Use Japanese Candles in Stock Indices

Japanese Candlestick Patterns Tutorial

Brief History

Candlesticks were developed in the 18th century by the legendary rice trader called Homma Munehisa to give an overview of opening, high, low and closing market stock index price over a given period of time.

They were used by the legendary rice trader to predict future market stock index prices. After dominating trading the rice market, Munehisa after that eventually moved to Tokyo Exchange where he gained huge fortunes using this analysis method. He is said to have made over one hundred consecutive winning trades.

Types of Stock Indices Trading charts

There are Three types of charts used in Stock Indices: Line, bar and candles.

Line - plots a continuous line connecting closing stock index prices of a stock indices.

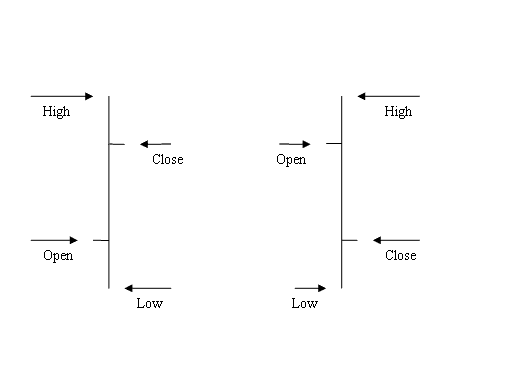

Bars- displayed as sequence of OHCL bars. O-H-C-L represents OPEN HIGH LOW & CLOSE. The Opening stock index price is displayed as a horizontal dash on the left & closing stock index price as a horizontal dash on the right.

The main disadvantage of a bars is that it isn't visually appealing, therefore most traders don't use them.

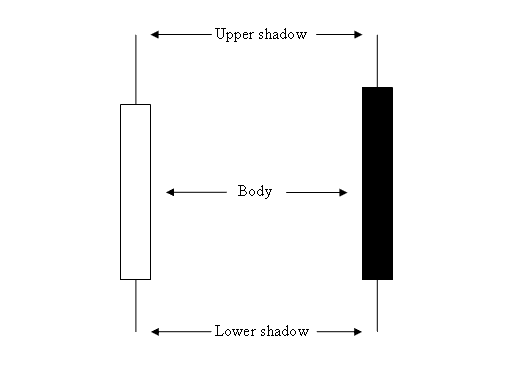

Candlesticks - these use the same price data as bar charts (open, high, low, & close). However, they in a much more visually identifiable way which resembles a candle with wicks on both its ends.

How to Analyze

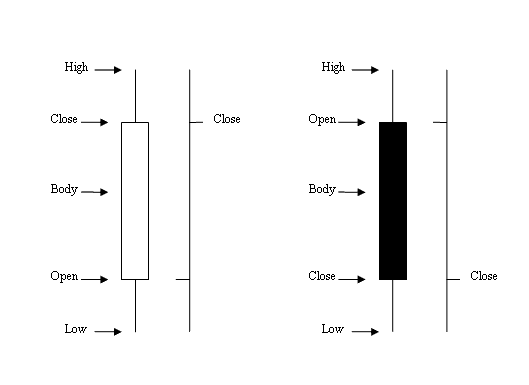

The rectangle section is called the body.

The high & low are described as shadows & plotted as poking lines.

The color is either blue or red

- (Blue or Green Color) - Indices Prices moved up

- (Red Color) - Indices Prices moved down

Most trading platforms like the MT4, use colors to mark the direction. Colors used are blue or green: when price moves up, red: when the price moves down.

Candlesticks Vs. Bar Chart

When candlesticks are used it is very easy to see if the stock index price moved up or down as opposed to when a bars are used.

The Japanese techniques also have very many formations that are used to trade the Stock Indices market. These patterns have different technical analysis explanation & the most common are:

The above patterns is what makes the Japanese candlesticks popular among technical traders & it is why this type of analysis are the most widely used when it comes to analyzing the stock indices market. The analysis for these pattern formations in stock index trading is the same as that one used in stocks trading.

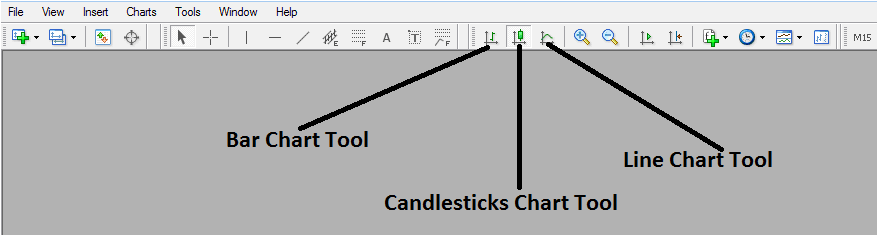

Drawing These Charts on MetaTrader 4

To draw these on the MT4, select the charts plotting tools within the "MetaTrader 4 Toolbar" - shown below.

To view this tool-bar on MT4 navigate to 'View' Next to file at the tops left corner of MT4 Platform, Click 'View', Then Click 'Tool bars', Then check 'Charts' Button. Above toolbar will appear.

Once the above tool-bar, appears you can then select the type you want to convert to, If you want to view using the bar format, click the bar tool button as shown above, for line format click the line tool button, for Japanese candlesticks format click the "candlesticks tool button".