Inertia Stocks Technical Analysis & Inertia Stocks Signals

Developed by Donald Dorsey & was originally used to trade Stocks & Commodities market, before stocks traders took it and started trading the stock trading market using this indicator.

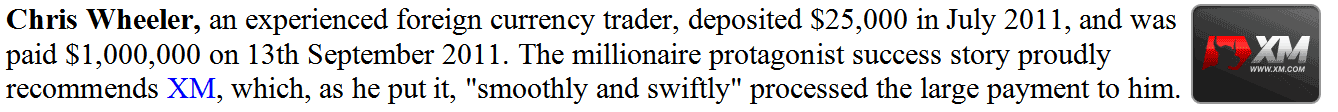

Dorsey chose to name it "Inertia" because of his interpretation of the stock trend. He claimed that a stock trading market stocks trend is the overall result of inertia and thus it takes more momentum for a trending market to reverse its direction than to continue moving in the same direction. Therefore, a stocks trend is the measurement of market inertia. This is an oscillator that uses the scale of zero to a hundred. Signals are generated using the 50 level center line crossover method.

In physics, the term Inertia is defined in terms of mass & direction of motion. Using standard technical analysis, the direction of motion of the stocks trend can be easily defined. However, the mass cannot be easily defined. Dorsey claimed that the volatility of a financial instrument may be the simplest & the most accurate measurement of inertia. This theory led to the use of the Relative Volatility Index (RVI) as the basis to be used as a stocks trend technical indicator. Therefore Inertia indicator is comprised of: RVI smoothed by a linear regression.

Stocks Technical Analysis and Generating Stock Signals

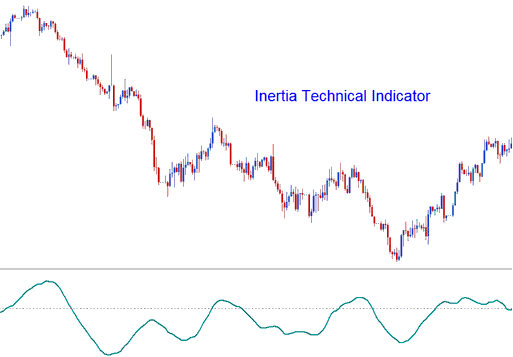

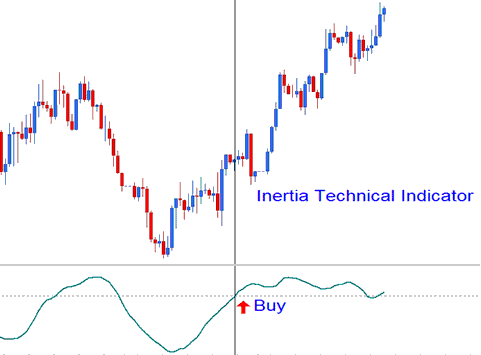

When it comes to trading the stocks market using this indicator, the signals generated are fairly simple to interpret. Below are two example illustrated using stocks charts showing how buy & sell signals are generated using Inertia.

Upward Stocks Trend

If the Inertia is above 50, positive inertia is indicated, this therefore defines the long-term stocks trend as upward as long as the indicator remains above 50. When it crosses to levels below 50 then this is interpreted as an exit signal. The chart below shows an example of how a buy signal is generated.

Upward Stocks Trend - Bullish Signal

Downward Stock Trend

If the Inertia is below 50, negative inertia is indicated, this therefore defines the long-term stocks trend as downwards as long as the indicator remains below 50. If it goes above 50 then this is interpreted as an exit signal. The stocks chart below shows how a sell signal generated.

Downward Stocks Trend - Bearish Signal